Friday, February 5, 2016

As a result of the high cost of replacing bobtails and other vehicles, propane marketers are holding on to their vehicles longer. At the same time, these marketers are experiencing a shortage of drivers and must do what they can to attract and retain those employees.

Benny Gay of Thompson Gas (Frederick, Md.) told BPN that although his company is not experiencing a driver shortage, propane marketers are spending extra money on aluminum decks and other features that help trucks last longer, especially in the colder climates where road salt can damage the truck body. ThompsonGas is also looking into adding automatic tire chain installers that allow the driver to deploy tire chains without having to step outside into the cold. ThompsonGas’ newly acquired Como Oil and Propane had purchased some new bobtails with this feature just prior to the acquisition. That’s one method companies are using to improve driver comfort. “More and more people are buying automatic tire chains,” said Roger Smith of Kurtz Truck Equipment (Marathon, N.Y.). “Flip a switch on the dash, and the chains are engaged.” Gay, meanwhile, is waiting to determine how much value the product brings and how much maintenance is involved.

But Gay believes those kinds of bells and whistles seem to be a trend. “Companies like ThompsonGas are moving toward full computerization in the cabs.”

Gay contends that marketers are spending more to run the trucks longer. In the past, he remembers a seven-year lifespan for bobtails being the norm. Now that’s moving to 10-plus, he noted. Marketers are spending the extra money on items such as aluminum decks, believing the investment to keep a truck running a few extra years is a wise investment.

Driver Shortage: A Product Trend

The entire trucking industry has experienced a shortage of qualified drivers, and the propane industry is no exception. “We’re starting to notice driver retention issues, which you wouldn’t think would have anything to do with a bobtail, but we think it does,” said Milt Swenson, who works in vessel sales and special projects for Westmor Industries (Morris, Minn.), a diversified supplier of equipment including trucks and trailers. He is hearing from marketers that their average driver age is rising. With many drivers near retirement, the propane companies are seeking to provide incentives to attract younger drivers to propane delivery careers and to retain the younger drivers they have. A more comfort-equipped chassis is one of those incentives, and a lot of marketers are seeking their drivers’ input on what other products they should include in the bobtail units. They will purchase some options Swenson mentioned that are gaining popularity, such as power hose reel assist for winding and unwinding the hoses, which the drivers in colder climates appreciate. More marketers are ordering hand-held controls with meter readouts, and many are ordering GPS routing for their on-board computers.

On the chassis side, bobtails with the usual comfort items such as air conditioning, power windows and locks, automatic transmissions, and back-up cameras continue to be popular. Will those items improve driver recruitment and retention?

“We think it will help a bit,” Swenson indicated. “If a driver feels like he’s part of the decision-making process, he obviously feels more in tune as a contributor to the overall company, and of course if they’re not sitting in a cold truck getting frozen every day without the nice amenities, it helps keep them from looking for a different job.” Westmor offers driver-comfort options such as lower filling heights so the driver doesn’t have to lift the hose as high when filling the bobtail, which Swenson says helps prevent driver fatigue.

He added that marketers are looking for ways to reduce overall maintenance cost by adding better finish coatings, such as rock guard or chip-guard applications to prevent stone and gravel damage to painted surfaces, because most of the units do not operate only on paved highways. Westmor is seeing a good response to a more modular deck design with replaceable fenders and other features to facilitate simpler repair from accident damage.

The use of stainless steel decks to eliminate corrosion issues has become more popular, Swenson noted, adding that they are a bit more expensive but the lower incidence of corrosion gives the truck a longer life. He has also seen an increase in hydraulic pumping systems versus the old power take-off (PTO) shafts, which provide faster pumping and less wear on the pump.

Availability from F-150 to F-750 and More

The Propane Education & Research Council (PERC) expects continued success in the bobtail and work truck market, not only with Freightliner Custom Chassis Corp. (FCCC) but with Ford in the medium-duty truck area. FCCC offers the S2G propane-fueled bobtail and box truck, and Ford sells the F-650 and F-750 that can run on propane. Recently, the F-150 became a new choice when Westport (Vancouver, B.C.) unveiled a liquid propane system for the vehicle and Impco (Santa Ana, Calif.) introduced a vapor system.

“Now we offer the F-150 in propane, and I think that’s going to be a strong seller as well, not only to our industry but also to outside fleets,” said Tucker Perkins, chief business development officer for PERC. “Now a prospective buyer can buy the entire lineup of F-Series trucks on propane.”

Todd Mouw of Roush CleanTech (Livonia, Mich.), whose company offers propane systems for the F-250 through F-750, noted that Ford will build the F-650 and F-750 truck at its Avon Lake, Ohio plant starting with the 2016 model year. Ford previously built the truck in Mexico through a joint venture with Navistar. “It’s a big change for Ford because they have 100% control over the quality of that truck,” stated Mouw, who is vice president of sales and marketing for Roush CleanTech. “Now it’s made and manufactured in the U.S. For the industry, we tout that we’re a domestic fuel. Now it’s a truck built domestically, and jobs are created domestically. Now we can use it for delivery of fuel converted to run on propane, so it’s a great story. It’s a domestically built truck, better quality, and warranted by the manufacturer with Roush’s fuel system using a domestic fuel that obviously the industry knows and loves. So it’s a great story and great trend.”

Mouw added that the trend of fleets offering propane will continue with the announcement from Roush at the Work Truck Show this coming March that “a very large beverage company” will deploy several hundred F-650 delivery trucks.

Roush’s F-750 bobtail, at 33,000 GVW, is in production, and the company will begin shipping vehicles in April. Reaction to the vehicle has been positive, according to Mouw.

“Additionally, the price point of the Ford chassis plus our fuel system is less than the diesel options they have been choosing from such as [FCCC],” he said. “Couple that with historically low propane prices, the federal tax credit being renewed for 2016, and the marketers’ cost to fuel their propane powered bobtail is less than 30 cents per gallon [wholesale cost minus 36 cents per gallon tax credit for propane]. The propane option is much easier to maintain as well, further increasing the cost per mile savings versus diesel.”

Curtis Donaldson, CEO of CleanFUEL USA (Georgetown, Texas), realized after his company became involved with the Westport F-150 product how much the propane industry and other companies with fleets wanted a half-ton pickup that runs on propane. CleanFUEL USA had been more involved with the three-quarter-ton truck market up to that point. He emphasized, however, that fleets still want the three-quarter-ton product, and his company will continue to provide it. But he admits that energy companies made up a large part of the customers for the three-quarter to one-ton market, and the energy sector is struggling now.

“That market may not be as robust this year unless the energy sector rebounds,” Donaldson noted. “But it’s good to have all three. Invariably you walk in and people use a combination of half and three quarter. Now it’s nice to say we’ve got both.” The passing of the alternative-fuel tax credit—36 cents per gallon for 2016—in addition to the fact that the medium-duty market uses a large amount of fuel will keep the medium-duty market strong for the propane industry. The light-duty market is a tougher sell at the moment, Donaldson explained, because fleets don’t tend to drive as many miles in them, so the combination of that with lower gasoline prices makes propane for those vehicles a more difficult value proposition for the propane industry to sell.

“I think lot of people are hunkered down, trying to keep everything moving in a positive direction until the differential is higher, but in the meantime I think we’ve still got a good value proposition for higher-mileage fleets,” Donaldson said. “Our focus is just that: Let’s go after the people that still have the economics.”

In other news illustrating the increasing availability of trucks that run on propane, Ed Hoffman, president of Blossman Services (Ocean Springs, Miss.), noted that the company is pursuing a certification on the Dodge Ram ProMaster, which he described as a European-style work van to compete with the Ford Transit. The U.S. Post Office announced the purchase of more than 9000 gasoline versions of the vehicle last year. “With that kind of activity, we’re interested in having a propane option for that vehicle.”

Hoffman added that he has noticed a trend of fleet customers downsizing the engines in their vehicles, forced by the choices the vehicle manufacturers offer. Ford van products are a good example. Ford replaced its E-series vans, available with V-8 and V-10 engines, with the Transit, which is only offered with a V-6 or small diesel. But Hoffman notes that customers are giving the Transit good reviews because they are getting the same performance out of the V-6.

“A trend you can identify is the downsizing of engines with equal performance of their old counterparts,” he noted. “That’s exciting for us, because we work very well in that space.”

Technology: It Keeps Getting Better

Next-generation technology, such as the ability of the front office to track a bobtail driver’s deliveries, is seeing increased use in the industry, said Danny McElroy, general manager and executive vice president for White River’s Southwest Sales Center in Dallas.

He is also seeing wider use of systems with point-of-sale capabilities that provide the delivery driver the ability to make management-approved pricing changes and calculate taxes for customers.

Tim Schweppe, general manager of the propane division for Arrow Tank (Minneapolis), agrees that technology in the propane industry continues to evolve. He told BPN that his company’s MOFLO model lineup, which provides flowrate capacities in excess of 100 gpm from the bobtail, continues to gain popularity among customers. Arrow and STAC Manufacturing (St. Paul) worked in conjunction to develop products that stabilize propane, or reduce boiling, inside the cargo tank while the liquid level drops during pumping. He noted that the STAC 100P heat exchanger and 500P hydraulic cooler are used independently or together along with Arrow’s piping system to keep propane in a happy liquid state while pumping.

Regarding additional technology that is emerging in the industry, Schweppe said radio frequency (RF) systems that marketers use to comply with off-truck remote closure regulations continue to evolve while the older systems reach the end of their life cycle. “In addition to the required E-Stop, nearly all our bobtails include remote PTO, throttle, reel-out, and meter display to assist by making the delivery process safer, more efficient, and improve equipment longevity,” he stated, adding that bobtails equipped with electronic registers are at an all-time high. Arrow built no more than three bobtails in the past eight years with mechanical registers, and the company is constantly retrofitting existing bobtails with electronics. Most of the retrofitting is triggered by back-office software introduced to the cab of the truck and the host in the form of a laptop or tablet. “We generally supply the mount, cradle/replicator, printer, and power supply and perform the interface between the host and register before the truck rolls out the door,” Schweppe said.

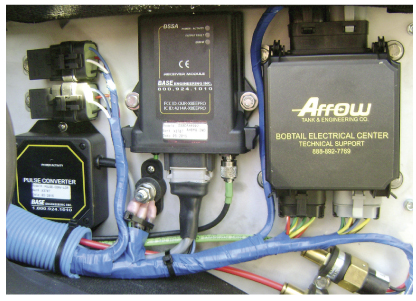

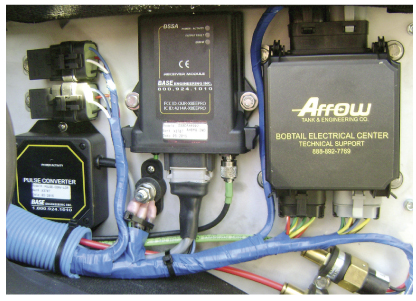

He added that in terms of building bobtails, wiring has become an essential part of the process due to the number of electronic and electrical items in use today. “Clean and reliable power is vital to making a bobtail pump. Keep in mind your typical bobtail may have 30-some electrical components, 400 feet in combined wiring harnesses, and each harness may have anywhere from two to 27 wires inside. Electrical architecture must be designed to be dependable, accessible, and friendly for troubleshooting.” All of Arrow’s electrical wiring is enclosed in blue loom or a blue jacket to clearly distinguish its work from the chassis manufacturer, and the company uses blue LED indicators to verify equipment status and glow fuses to easily identify an open circuit.

Hoffman of Blossman Services added that the idea of “big data” is another trend he sees in the industry. Customers, he explained, require information to make good decisions. His company’s Triton Fuel Management System helps the marketer track by vehicle what type of fuel is being consumed. All Blossman customers receive a dedicated Alliance AutoGas fuel card that tracks fuel transactions by vehicle, the vehicle’s current mileage, the identification of the driver, and how many gallons the driver is pumping.

All of the advanced technology has been positive for the propane truck industry, but Danny McElroy said he would not buy a bobtail without some of the older technology that is still important. He noted that tornadoes hit his area of Garland, Texas on Dec. 26, and several trailer parks that use propane as a power source were hit hard. He was thankful for the ability to evacuate propane tanks to a bobtail without using a generator or compressor. White River now installs extra plumbing to the bobtail for self-loading at a bulk plant in the event of a power outage. That system can also be used to evacuate domestic tanks in the field without a generator or compressor. The technology has been around for a few years, but White River began including the “self-load and tank evacuation” technology as standard equipment last year.

Emissions Regulations Add Complexity for Diesels

Emissions regulations have resulted in a change in requirements for diesel-fueled bobtails, said Jim Ham, general manager for Stoops-Freightliner in Fort Wayne, Ind. “That has not only added complexity to the whole vehicle, but a lot of cost,” he noted. “Diesel engines have gotten cleaner, but cost has gone up to meet those emissions. Propane engines are naturally clean and do not have all the emission controls.”

Mitch Vanover of Miles Propane (Owensboro, Ky.) noted that International held about 60% of the bobtail market, but that declined because of emissions testing, and Freightliner has stepped up its share. “We were committed to International for years until the last three years, when we switched to Freightliner because of the changes they made,” Vanover added.

Tank Head Situation: In Good Shape

The bobtail tank head shortage that occurred in 2014 has been resolved. In fact, it has reversed itself as propane demand declined along with the drop in oil prices, said Swenson of Westmor. Trinity Containers (Dallas) repaired its head press, and tank manufacturers were able to catch up with demand. The milder weather in much of the country helped bring vessel product lead times back to normal levels. Swenson added that a benefit of the tank head shortage was that marketers learned to plan their product purchases more in advance to ensure they receive their equipment in time for the busy season.

Swenson emphasized that market conditions have a major effect on bobtail markets. “As always, one of the primary indicators of bobtail truck markets is still weather-driven,” he said in early January. “Winter’s impact this year has yet to be determined. It started out a bit warm, but now we’re getting cold again.”

Transport Trends: Vehicles Getting Safer

Propane transport companies are spec’ing the trucks with many new safety features, said Frank Venezia of propane hauler Venezia Inc. (Pottstown, Pa.). Antilock brakes have been standard, but the industry is moving toward disc brakes for better stopping power.

Fleets are equipping the trailers with additional safety features such as anti-rollover stability control. Automatic transmissions are another trend. Venezia said new equipment comes with technology commonly associated with cars, such as lane departure warnings, adaptive cruise control, and collision-avoidance systems to make sure drivers don’t follow too closely.

Venezia, whose company transports a diverse portfolio of dry bulk products and liquid products in addition to propane and butane, noted that improved technology is ordered more frequently in transports. To meet the needs of customers who want to receive paperwork such as delivery confirmations more quickly, the industry is moving toward onboard document scanning. Onboard scanning provides a method for the driver to run documents such as bills of lading through a scanner that send it to the corporate office almost immediately.

PERC Activity in Direct Injection

The news that President Obama on Dec. 18 signed HR 2029, the combined tax-relief and government funding legislation (BPN, Jan. 2016, p. 15) was good news for the propane industry. In addition to an extension of the 50-cent-per-gallon alternative-fuels tax credit (36 cents for 2016) and the alternative fuel vehicle refilling property credit for two years, the legislation provided several million dollars toward research on propane/LPG direct-injection engines. Perkins of PERC said the council will collaborate with the National Propane Gas Association (NPGA) and will use the funding to work with original equipment manufacturers to provide them with the ability to use a propane-fueled direct-injection engine, to complete research to show how efficient propane runs in a direct-injection engine, and to communicate with members of the public so they feel comfortable buying such vehicles.

“I think you will see this is the year we prove the performance and emissions benefits of propane direct-injection engines so we are prepared for the vehicles for 2017 and on,” Perkins said.

He provided an update on package delivery company UPS, which in 2014 bought and deployed 1000 propane-fueled vehicles, mainly in California, Georgia, North Carolina, Colorado, Oklahoma, and Louisiana. Perkins stated that the units are running flawlessly, and driver acceptance has been overwhelmingly positive. But he noted frustration in other areas.

“What we haven’t been able to do is translate that positive experience into a corporate commitment to buy propane,” Perkins commented. “It’s not an indictment against propane. In a stealthy way, they continue to buy a few vehicles here and there. We would hope that this positive experience with propane not only increases the commitment of UPS to propane, but provides confidence to act to those companies that appreciate the diligence UPS has before committing to their choice of fuel.”

Public transit fleets have continued the trend of choosing propane to transport people, mainly in E-450-type shuttles. Strong examples are Roush CleanTech’s work with Smart Paratransit last year, Flint MTA in 2013, and various others. —Daryl Lubinsky

Benny Gay of Thompson Gas (Frederick, Md.) told BPN that although his company is not experiencing a driver shortage, propane marketers are spending extra money on aluminum decks and other features that help trucks last longer, especially in the colder climates where road salt can damage the truck body. ThompsonGas is also looking into adding automatic tire chain installers that allow the driver to deploy tire chains without having to step outside into the cold. ThompsonGas’ newly acquired Como Oil and Propane had purchased some new bobtails with this feature just prior to the acquisition. That’s one method companies are using to improve driver comfort. “More and more people are buying automatic tire chains,” said Roger Smith of Kurtz Truck Equipment (Marathon, N.Y.). “Flip a switch on the dash, and the chains are engaged.” Gay, meanwhile, is waiting to determine how much value the product brings and how much maintenance is involved.

But Gay believes those kinds of bells and whistles seem to be a trend. “Companies like ThompsonGas are moving toward full computerization in the cabs.”

Gay contends that marketers are spending more to run the trucks longer. In the past, he remembers a seven-year lifespan for bobtails being the norm. Now that’s moving to 10-plus, he noted. Marketers are spending the extra money on items such as aluminum decks, believing the investment to keep a truck running a few extra years is a wise investment.

Driver Shortage: A Product Trend

The entire trucking industry has experienced a shortage of qualified drivers, and the propane industry is no exception. “We’re starting to notice driver retention issues, which you wouldn’t think would have anything to do with a bobtail, but we think it does,” said Milt Swenson, who works in vessel sales and special projects for Westmor Industries (Morris, Minn.), a diversified supplier of equipment including trucks and trailers. He is hearing from marketers that their average driver age is rising. With many drivers near retirement, the propane companies are seeking to provide incentives to attract younger drivers to propane delivery careers and to retain the younger drivers they have. A more comfort-equipped chassis is one of those incentives, and a lot of marketers are seeking their drivers’ input on what other products they should include in the bobtail units. They will purchase some options Swenson mentioned that are gaining popularity, such as power hose reel assist for winding and unwinding the hoses, which the drivers in colder climates appreciate. More marketers are ordering hand-held controls with meter readouts, and many are ordering GPS routing for their on-board computers.

On the chassis side, bobtails with the usual comfort items such as air conditioning, power windows and locks, automatic transmissions, and back-up cameras continue to be popular. Will those items improve driver recruitment and retention?

“We think it will help a bit,” Swenson indicated. “If a driver feels like he’s part of the decision-making process, he obviously feels more in tune as a contributor to the overall company, and of course if they’re not sitting in a cold truck getting frozen every day without the nice amenities, it helps keep them from looking for a different job.” Westmor offers driver-comfort options such as lower filling heights so the driver doesn’t have to lift the hose as high when filling the bobtail, which Swenson says helps prevent driver fatigue.

He added that marketers are looking for ways to reduce overall maintenance cost by adding better finish coatings, such as rock guard or chip-guard applications to prevent stone and gravel damage to painted surfaces, because most of the units do not operate only on paved highways. Westmor is seeing a good response to a more modular deck design with replaceable fenders and other features to facilitate simpler repair from accident damage.

The use of stainless steel decks to eliminate corrosion issues has become more popular, Swenson noted, adding that they are a bit more expensive but the lower incidence of corrosion gives the truck a longer life. He has also seen an increase in hydraulic pumping systems versus the old power take-off (PTO) shafts, which provide faster pumping and less wear on the pump.

Availability from F-150 to F-750 and More

The Propane Education & Research Council (PERC) expects continued success in the bobtail and work truck market, not only with Freightliner Custom Chassis Corp. (FCCC) but with Ford in the medium-duty truck area. FCCC offers the S2G propane-fueled bobtail and box truck, and Ford sells the F-650 and F-750 that can run on propane. Recently, the F-150 became a new choice when Westport (Vancouver, B.C.) unveiled a liquid propane system for the vehicle and Impco (Santa Ana, Calif.) introduced a vapor system.

“Now we offer the F-150 in propane, and I think that’s going to be a strong seller as well, not only to our industry but also to outside fleets,” said Tucker Perkins, chief business development officer for PERC. “Now a prospective buyer can buy the entire lineup of F-Series trucks on propane.”

Todd Mouw of Roush CleanTech (Livonia, Mich.), whose company offers propane systems for the F-250 through F-750, noted that Ford will build the F-650 and F-750 truck at its Avon Lake, Ohio plant starting with the 2016 model year. Ford previously built the truck in Mexico through a joint venture with Navistar. “It’s a big change for Ford because they have 100% control over the quality of that truck,” stated Mouw, who is vice president of sales and marketing for Roush CleanTech. “Now it’s made and manufactured in the U.S. For the industry, we tout that we’re a domestic fuel. Now it’s a truck built domestically, and jobs are created domestically. Now we can use it for delivery of fuel converted to run on propane, so it’s a great story. It’s a domestically built truck, better quality, and warranted by the manufacturer with Roush’s fuel system using a domestic fuel that obviously the industry knows and loves. So it’s a great story and great trend.”

Mouw added that the trend of fleets offering propane will continue with the announcement from Roush at the Work Truck Show this coming March that “a very large beverage company” will deploy several hundred F-650 delivery trucks.

Roush’s F-750 bobtail, at 33,000 GVW, is in production, and the company will begin shipping vehicles in April. Reaction to the vehicle has been positive, according to Mouw.

“Additionally, the price point of the Ford chassis plus our fuel system is less than the diesel options they have been choosing from such as [FCCC],” he said. “Couple that with historically low propane prices, the federal tax credit being renewed for 2016, and the marketers’ cost to fuel their propane powered bobtail is less than 30 cents per gallon [wholesale cost minus 36 cents per gallon tax credit for propane]. The propane option is much easier to maintain as well, further increasing the cost per mile savings versus diesel.”

Curtis Donaldson, CEO of CleanFUEL USA (Georgetown, Texas), realized after his company became involved with the Westport F-150 product how much the propane industry and other companies with fleets wanted a half-ton pickup that runs on propane. CleanFUEL USA had been more involved with the three-quarter-ton truck market up to that point. He emphasized, however, that fleets still want the three-quarter-ton product, and his company will continue to provide it. But he admits that energy companies made up a large part of the customers for the three-quarter to one-ton market, and the energy sector is struggling now.

“That market may not be as robust this year unless the energy sector rebounds,” Donaldson noted. “But it’s good to have all three. Invariably you walk in and people use a combination of half and three quarter. Now it’s nice to say we’ve got both.” The passing of the alternative-fuel tax credit—36 cents per gallon for 2016—in addition to the fact that the medium-duty market uses a large amount of fuel will keep the medium-duty market strong for the propane industry. The light-duty market is a tougher sell at the moment, Donaldson explained, because fleets don’t tend to drive as many miles in them, so the combination of that with lower gasoline prices makes propane for those vehicles a more difficult value proposition for the propane industry to sell.

“I think lot of people are hunkered down, trying to keep everything moving in a positive direction until the differential is higher, but in the meantime I think we’ve still got a good value proposition for higher-mileage fleets,” Donaldson said. “Our focus is just that: Let’s go after the people that still have the economics.”

In other news illustrating the increasing availability of trucks that run on propane, Ed Hoffman, president of Blossman Services (Ocean Springs, Miss.), noted that the company is pursuing a certification on the Dodge Ram ProMaster, which he described as a European-style work van to compete with the Ford Transit. The U.S. Post Office announced the purchase of more than 9000 gasoline versions of the vehicle last year. “With that kind of activity, we’re interested in having a propane option for that vehicle.”

Hoffman added that he has noticed a trend of fleet customers downsizing the engines in their vehicles, forced by the choices the vehicle manufacturers offer. Ford van products are a good example. Ford replaced its E-series vans, available with V-8 and V-10 engines, with the Transit, which is only offered with a V-6 or small diesel. But Hoffman notes that customers are giving the Transit good reviews because they are getting the same performance out of the V-6.

“A trend you can identify is the downsizing of engines with equal performance of their old counterparts,” he noted. “That’s exciting for us, because we work very well in that space.”

Technology: It Keeps Getting Better

Next-generation technology, such as the ability of the front office to track a bobtail driver’s deliveries, is seeing increased use in the industry, said Danny McElroy, general manager and executive vice president for White River’s Southwest Sales Center in Dallas.

He is also seeing wider use of systems with point-of-sale capabilities that provide the delivery driver the ability to make management-approved pricing changes and calculate taxes for customers.

Tim Schweppe, general manager of the propane division for Arrow Tank (Minneapolis), agrees that technology in the propane industry continues to evolve. He told BPN that his company’s MOFLO model lineup, which provides flowrate capacities in excess of 100 gpm from the bobtail, continues to gain popularity among customers. Arrow and STAC Manufacturing (St. Paul) worked in conjunction to develop products that stabilize propane, or reduce boiling, inside the cargo tank while the liquid level drops during pumping. He noted that the STAC 100P heat exchanger and 500P hydraulic cooler are used independently or together along with Arrow’s piping system to keep propane in a happy liquid state while pumping.

Regarding additional technology that is emerging in the industry, Schweppe said radio frequency (RF) systems that marketers use to comply with off-truck remote closure regulations continue to evolve while the older systems reach the end of their life cycle. “In addition to the required E-Stop, nearly all our bobtails include remote PTO, throttle, reel-out, and meter display to assist by making the delivery process safer, more efficient, and improve equipment longevity,” he stated, adding that bobtails equipped with electronic registers are at an all-time high. Arrow built no more than three bobtails in the past eight years with mechanical registers, and the company is constantly retrofitting existing bobtails with electronics. Most of the retrofitting is triggered by back-office software introduced to the cab of the truck and the host in the form of a laptop or tablet. “We generally supply the mount, cradle/replicator, printer, and power supply and perform the interface between the host and register before the truck rolls out the door,” Schweppe said.

He added that in terms of building bobtails, wiring has become an essential part of the process due to the number of electronic and electrical items in use today. “Clean and reliable power is vital to making a bobtail pump. Keep in mind your typical bobtail may have 30-some electrical components, 400 feet in combined wiring harnesses, and each harness may have anywhere from two to 27 wires inside. Electrical architecture must be designed to be dependable, accessible, and friendly for troubleshooting.” All of Arrow’s electrical wiring is enclosed in blue loom or a blue jacket to clearly distinguish its work from the chassis manufacturer, and the company uses blue LED indicators to verify equipment status and glow fuses to easily identify an open circuit.

Hoffman of Blossman Services added that the idea of “big data” is another trend he sees in the industry. Customers, he explained, require information to make good decisions. His company’s Triton Fuel Management System helps the marketer track by vehicle what type of fuel is being consumed. All Blossman customers receive a dedicated Alliance AutoGas fuel card that tracks fuel transactions by vehicle, the vehicle’s current mileage, the identification of the driver, and how many gallons the driver is pumping.

All of the advanced technology has been positive for the propane truck industry, but Danny McElroy said he would not buy a bobtail without some of the older technology that is still important. He noted that tornadoes hit his area of Garland, Texas on Dec. 26, and several trailer parks that use propane as a power source were hit hard. He was thankful for the ability to evacuate propane tanks to a bobtail without using a generator or compressor. White River now installs extra plumbing to the bobtail for self-loading at a bulk plant in the event of a power outage. That system can also be used to evacuate domestic tanks in the field without a generator or compressor. The technology has been around for a few years, but White River began including the “self-load and tank evacuation” technology as standard equipment last year.

Emissions Regulations Add Complexity for Diesels

Emissions regulations have resulted in a change in requirements for diesel-fueled bobtails, said Jim Ham, general manager for Stoops-Freightliner in Fort Wayne, Ind. “That has not only added complexity to the whole vehicle, but a lot of cost,” he noted. “Diesel engines have gotten cleaner, but cost has gone up to meet those emissions. Propane engines are naturally clean and do not have all the emission controls.”

Mitch Vanover of Miles Propane (Owensboro, Ky.) noted that International held about 60% of the bobtail market, but that declined because of emissions testing, and Freightliner has stepped up its share. “We were committed to International for years until the last three years, when we switched to Freightliner because of the changes they made,” Vanover added.

Tank Head Situation: In Good Shape

The bobtail tank head shortage that occurred in 2014 has been resolved. In fact, it has reversed itself as propane demand declined along with the drop in oil prices, said Swenson of Westmor. Trinity Containers (Dallas) repaired its head press, and tank manufacturers were able to catch up with demand. The milder weather in much of the country helped bring vessel product lead times back to normal levels. Swenson added that a benefit of the tank head shortage was that marketers learned to plan their product purchases more in advance to ensure they receive their equipment in time for the busy season.

Swenson emphasized that market conditions have a major effect on bobtail markets. “As always, one of the primary indicators of bobtail truck markets is still weather-driven,” he said in early January. “Winter’s impact this year has yet to be determined. It started out a bit warm, but now we’re getting cold again.”

Transport Trends: Vehicles Getting Safer

Propane transport companies are spec’ing the trucks with many new safety features, said Frank Venezia of propane hauler Venezia Inc. (Pottstown, Pa.). Antilock brakes have been standard, but the industry is moving toward disc brakes for better stopping power.

Fleets are equipping the trailers with additional safety features such as anti-rollover stability control. Automatic transmissions are another trend. Venezia said new equipment comes with technology commonly associated with cars, such as lane departure warnings, adaptive cruise control, and collision-avoidance systems to make sure drivers don’t follow too closely.

Venezia, whose company transports a diverse portfolio of dry bulk products and liquid products in addition to propane and butane, noted that improved technology is ordered more frequently in transports. To meet the needs of customers who want to receive paperwork such as delivery confirmations more quickly, the industry is moving toward onboard document scanning. Onboard scanning provides a method for the driver to run documents such as bills of lading through a scanner that send it to the corporate office almost immediately.

PERC Activity in Direct Injection

The news that President Obama on Dec. 18 signed HR 2029, the combined tax-relief and government funding legislation (BPN, Jan. 2016, p. 15) was good news for the propane industry. In addition to an extension of the 50-cent-per-gallon alternative-fuels tax credit (36 cents for 2016) and the alternative fuel vehicle refilling property credit for two years, the legislation provided several million dollars toward research on propane/LPG direct-injection engines. Perkins of PERC said the council will collaborate with the National Propane Gas Association (NPGA) and will use the funding to work with original equipment manufacturers to provide them with the ability to use a propane-fueled direct-injection engine, to complete research to show how efficient propane runs in a direct-injection engine, and to communicate with members of the public so they feel comfortable buying such vehicles.

“I think you will see this is the year we prove the performance and emissions benefits of propane direct-injection engines so we are prepared for the vehicles for 2017 and on,” Perkins said.

He provided an update on package delivery company UPS, which in 2014 bought and deployed 1000 propane-fueled vehicles, mainly in California, Georgia, North Carolina, Colorado, Oklahoma, and Louisiana. Perkins stated that the units are running flawlessly, and driver acceptance has been overwhelmingly positive. But he noted frustration in other areas.

“What we haven’t been able to do is translate that positive experience into a corporate commitment to buy propane,” Perkins commented. “It’s not an indictment against propane. In a stealthy way, they continue to buy a few vehicles here and there. We would hope that this positive experience with propane not only increases the commitment of UPS to propane, but provides confidence to act to those companies that appreciate the diligence UPS has before committing to their choice of fuel.”

Public transit fleets have continued the trend of choosing propane to transport people, mainly in E-450-type shuttles. Strong examples are Roush CleanTech’s work with Smart Paratransit last year, Flint MTA in 2013, and various others. —Daryl Lubinsky