Wednesday, January 13, 2016

While continuing development of the propane engine fuel markets is expected to provide significant growth opportunities, traditional markets will continue to face competition from electric technologies, expansion of the natural gas distribution system, and long-term energy efficiency trends. Those are among the observations included in the “2016 Propane Market Outlook” released in November, a report commissioned by the Propane Education & Research Council (PERC) for the industry and authored by Fairfax, Va.-based ICF International. The study undertakes to identify key market trends, opportunities, and threats facing the propane industry through 2025.

Principal author Michael Sloan notes that the consumer propane market is in the midst of a period of very rapid change. Competition with electricity will continue to be a major challenge to growth in propane sales in most residential and commercial markets. However, although the price of electricity varies widely by location, with some markets likely to see prices as much as 40% higher or lower than the state average, higher prices are often set by small municipal utilities that serve areas with a high concentration of propane customers. Therefore, propane can be competitive with electricity in many communities, even in states with relatively low average electricity prices.

ICF expects the ongoing decline in propane prices to lead to a significant near-term improvement in the relationship between propane and electricity prices in most major propane markets. Although soft natural gas prices continue to translate into lower electricity rates in certain higher-cost markets such as New England and the Northeastern U.S., the decline in retail propane prices is expected to be greater than any potential decline in electricity prices. In the longer term, increases in power generation investments related to implementation of emissions regulations are expected to lead to a slow increase in future electricity prices, partially offsetting any rebound in propane prices. The U.S. Department of Energy’s annual energy outlook is projecting average residential electricity prices to increase by about 12% between 2015 and 2025.

Overall, ICF finds that electricity’s share of the home heating market has been increasing rapidly, particularly in the South, but also in some northern states. The share of homes heated with wood has also been increasing in the last few years, particularly in New England and the Upper Midwest. Many of these homes switched from propane and fueloil to wood due to increased fuel prices, although many of the homes that switched to wood from propane can heat with either energy source and are likely to switch back as propane prices moderate.

Further, propane gained market share in 1,127, or 36%, of U.S. counties between 2010 and 2014. Much of the growth occurred in counties where fueloil market share declined, but in a surprising number of counties, propane increased market share at the same time that natural gas market share was declining. In these counties, the propane market was increasing due to new housing growth and conversions from other fuels, while the natural gas system was not expanding, or was losing share to electricity.

Propane’s share of the residential space heating market declined in 2,013 U.S. counties between 2010 and 2014. In the majority of these counties, electricity was the fastest-growing source for residential space heat, although natural gas and wood also captured shares of the market in many counties. The decline in propane prices is expected to change the market dynamic in the short term, slowing down propane customer losses to electricity and natural gas.

Much of the loss in propane market share in the residential sector in recent years is attributable to competition with conventional electric heat pumps, ICF International explains. This competition is expected to intensify over time as ongoing technological improvements reduce or eliminate heat pumps’ traditional shortcomings. In addition to improved operating characteristics at low temperatures, the heat output from modern heat pumps has increased, improving the comfort they deliver. Equipment reliability and lifespan have also improved. As heat pump technology continues to advance, conventional heat pumps will be a growing threat to the propane heating market.

Energy Policy

National energy policies, reflected in alternative fuel and energy efficiency tax credits and water heater efficiency standards can make propane applications more attractive in the marketplace. However, these policies are also likely to increase the energy efficiency of propane applications, accelerating a long-term trend that would reduce propane sales per application relative to existing equipment. New energy policies and regulations also have the potential to tilt the playing field in favor of electricity or other fuels in certain applications.

Appliance and energy efficiency standards and more energy efficient building codes have driven a long-term decline in average propane sales per customer in the residential and commercial sectors, directly impacting propane sales to both new and existing customers. Such standards and codes also promote technological improvements in competing technologies, such as heat pumps and heat pump water heaters.

Existing building code and appliance efficiency standards are expected to result in a continuing decline in average propane use per residential customer of between 1% and 1.5% per year. The tightening of energy efficiency standards will have a significant impact on the economics and energy use of applications, and should be expected to accelerate the decline in propane use per customer for residential customers. However, the recent changes in efficiency standards for water heaters provide an opportunity, particularly for propane tankless water heaters, to capture additional market share and grow propane loads.

“The national policy focus on energy issues—including energy security, energy efficiency, and emissions—is also likely to result in greater promotion of high-efficiency electric appliances,” ICF cautions. “The propane industry can expect to see significant expansion in the number of utility-sponsored programs that provide incentives for high-efficiency conventional heat pumps and GHPs, and high-efficiency 100% electric homes, in many regions of the country.”

The consultancy highlights that the propane industry has been constrained in its efforts to communicate directly with consumers since the Department of Commerce restricted PERC activities in 2009. However, with the lifting of those constraints in 2015 and newly revised language approved by Congress in the Propane Education and Research Act, PERC is now able to use additional tools to educate consumers about propane. This additional flexibility should enable the propane industry to be more effective in reaching consumers in the future.

Engine Fuel

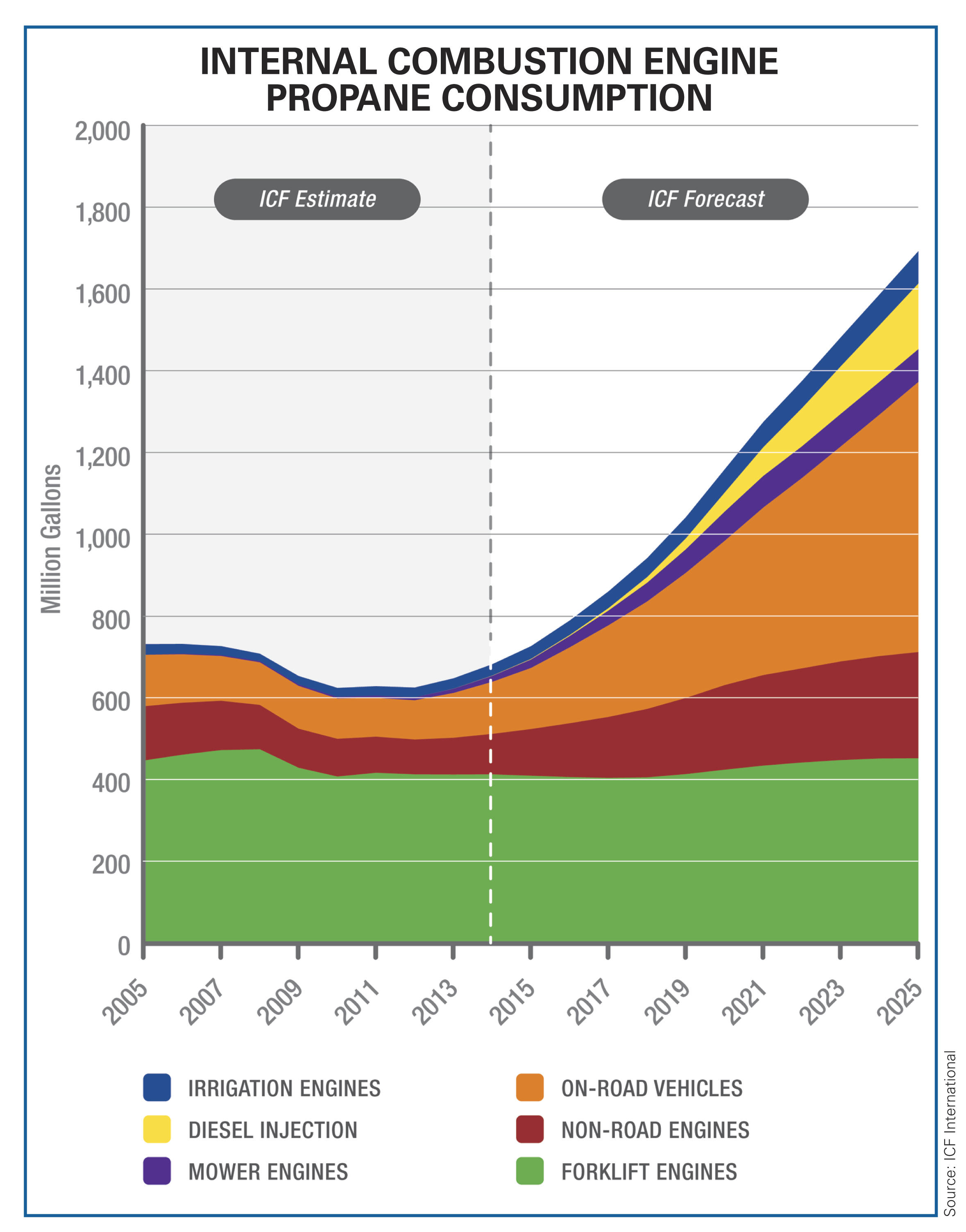

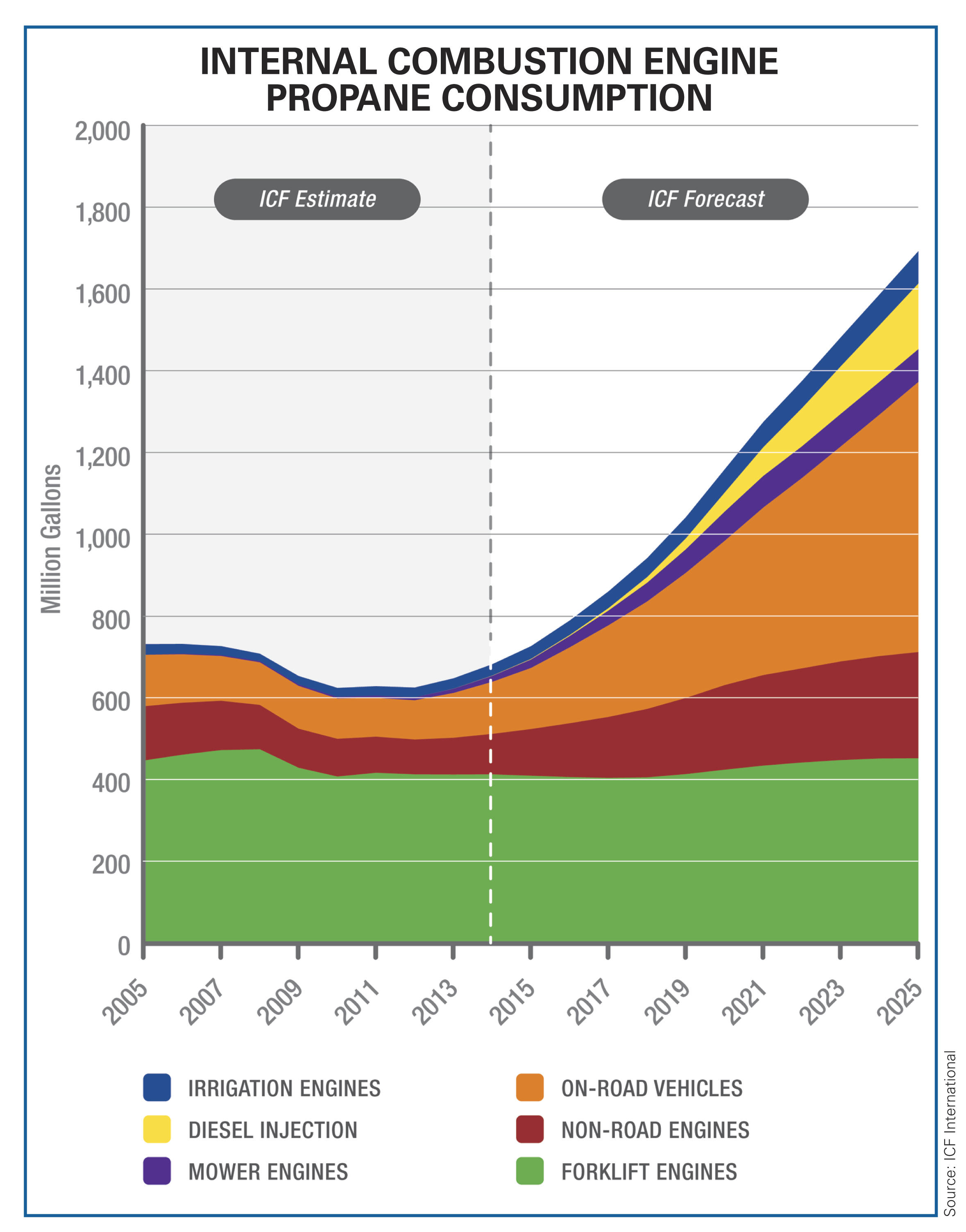

ICF is projecting propane sales in the internal combustion engine market to increase from about 640 MMgal. in 2014 to about 1.7 Bgal. by 2025. For on-road vehicles, propane provides a viable alternative to gasoline and diesel fuel and has significant environmental advantages relative to both conventional fuels. In addition, delivered propane prices to large fleet customers are expected to result in significant fuel cost savings relative to gasoline- and diesel-fueled fleets.

Investments by PERC, Roush CleanTech, Blue Bird Corp., CleanFUEL USA, Alliance AutoGas, Thomas Built, IC Bus, Freightliner Custom Chassis and others have led to the introduction of a number of new propane-powered vehicles and engines. Industry partnerships with additional original equipment manufacturers, including the PERC partnership with Freightliner, have the potential to expand the number of vehicles and engines available to the market in the longer term.

The introduction of new propane-powered vehicles is expected to generate a near-term increase in propane sales in this market. Propane school bus sales are expected to account for about 10% of the total school bus market in 2015, and propane vehicles are making significant gains in other fleet vehicle markets such as box trucks and shuttle vans. However, the propane industry will need to overcome significant market hurdles to maximize sales in this sector. “In the past, much of the alternative fuel market has been driven by customer preferences to be seen as ‘green,’ as well as the need to comply with alternative fuel requirements and objectives rather than for cost or performance reasons,” ICF underscores. “In addition, much of the alternative fuel market has been sustained by fuel and refueling infrastructure tax incentives.”

Conversely, more recently the growth in propane vehicle sales has been driven by the difference between propane and gasoline/diesel prices in vehicle fleet applications. Fuel cost savings enable propane vehicles to make sense on a straight economic basis in most small to mid-size fleet applications, including school buses, shuttles and taxis, delivery vehicle fleets, law enforcement fleets, and other fleet vehicle applications where vehicles are based at a single location. The recent decline in oil prices has reduced the fuel cost savings associated with propane, but has not eliminated the total cost of ownership economic benefits associated with converting to propane vehicles.

ICF estimates that about 12,900 new propane vehicles were sold or converted in 2014. It projects total propane vehicle sales and conversions to increase to 52,000 a year by 2025. That growth in new propane vehicle sales is expected to be split 40% for light duty and 60% for medium duty. Most of the medium-duty vehicles are expected to be OEM vehicles, while most of the light-duty vehicles are expected to be conversions.

Principal author Michael Sloan notes that the consumer propane market is in the midst of a period of very rapid change. Competition with electricity will continue to be a major challenge to growth in propane sales in most residential and commercial markets. However, although the price of electricity varies widely by location, with some markets likely to see prices as much as 40% higher or lower than the state average, higher prices are often set by small municipal utilities that serve areas with a high concentration of propane customers. Therefore, propane can be competitive with electricity in many communities, even in states with relatively low average electricity prices.

ICF expects the ongoing decline in propane prices to lead to a significant near-term improvement in the relationship between propane and electricity prices in most major propane markets. Although soft natural gas prices continue to translate into lower electricity rates in certain higher-cost markets such as New England and the Northeastern U.S., the decline in retail propane prices is expected to be greater than any potential decline in electricity prices. In the longer term, increases in power generation investments related to implementation of emissions regulations are expected to lead to a slow increase in future electricity prices, partially offsetting any rebound in propane prices. The U.S. Department of Energy’s annual energy outlook is projecting average residential electricity prices to increase by about 12% between 2015 and 2025.

Overall, ICF finds that electricity’s share of the home heating market has been increasing rapidly, particularly in the South, but also in some northern states. The share of homes heated with wood has also been increasing in the last few years, particularly in New England and the Upper Midwest. Many of these homes switched from propane and fueloil to wood due to increased fuel prices, although many of the homes that switched to wood from propane can heat with either energy source and are likely to switch back as propane prices moderate.

Further, propane gained market share in 1,127, or 36%, of U.S. counties between 2010 and 2014. Much of the growth occurred in counties where fueloil market share declined, but in a surprising number of counties, propane increased market share at the same time that natural gas market share was declining. In these counties, the propane market was increasing due to new housing growth and conversions from other fuels, while the natural gas system was not expanding, or was losing share to electricity.

Propane’s share of the residential space heating market declined in 2,013 U.S. counties between 2010 and 2014. In the majority of these counties, electricity was the fastest-growing source for residential space heat, although natural gas and wood also captured shares of the market in many counties. The decline in propane prices is expected to change the market dynamic in the short term, slowing down propane customer losses to electricity and natural gas.

Much of the loss in propane market share in the residential sector in recent years is attributable to competition with conventional electric heat pumps, ICF International explains. This competition is expected to intensify over time as ongoing technological improvements reduce or eliminate heat pumps’ traditional shortcomings. In addition to improved operating characteristics at low temperatures, the heat output from modern heat pumps has increased, improving the comfort they deliver. Equipment reliability and lifespan have also improved. As heat pump technology continues to advance, conventional heat pumps will be a growing threat to the propane heating market.

Energy Policy

National energy policies, reflected in alternative fuel and energy efficiency tax credits and water heater efficiency standards can make propane applications more attractive in the marketplace. However, these policies are also likely to increase the energy efficiency of propane applications, accelerating a long-term trend that would reduce propane sales per application relative to existing equipment. New energy policies and regulations also have the potential to tilt the playing field in favor of electricity or other fuels in certain applications.

Appliance and energy efficiency standards and more energy efficient building codes have driven a long-term decline in average propane sales per customer in the residential and commercial sectors, directly impacting propane sales to both new and existing customers. Such standards and codes also promote technological improvements in competing technologies, such as heat pumps and heat pump water heaters.

Existing building code and appliance efficiency standards are expected to result in a continuing decline in average propane use per residential customer of between 1% and 1.5% per year. The tightening of energy efficiency standards will have a significant impact on the economics and energy use of applications, and should be expected to accelerate the decline in propane use per customer for residential customers. However, the recent changes in efficiency standards for water heaters provide an opportunity, particularly for propane tankless water heaters, to capture additional market share and grow propane loads.

“The national policy focus on energy issues—including energy security, energy efficiency, and emissions—is also likely to result in greater promotion of high-efficiency electric appliances,” ICF cautions. “The propane industry can expect to see significant expansion in the number of utility-sponsored programs that provide incentives for high-efficiency conventional heat pumps and GHPs, and high-efficiency 100% electric homes, in many regions of the country.”

The consultancy highlights that the propane industry has been constrained in its efforts to communicate directly with consumers since the Department of Commerce restricted PERC activities in 2009. However, with the lifting of those constraints in 2015 and newly revised language approved by Congress in the Propane Education and Research Act, PERC is now able to use additional tools to educate consumers about propane. This additional flexibility should enable the propane industry to be more effective in reaching consumers in the future.

Engine Fuel

ICF is projecting propane sales in the internal combustion engine market to increase from about 640 MMgal. in 2014 to about 1.7 Bgal. by 2025. For on-road vehicles, propane provides a viable alternative to gasoline and diesel fuel and has significant environmental advantages relative to both conventional fuels. In addition, delivered propane prices to large fleet customers are expected to result in significant fuel cost savings relative to gasoline- and diesel-fueled fleets.

Investments by PERC, Roush CleanTech, Blue Bird Corp., CleanFUEL USA, Alliance AutoGas, Thomas Built, IC Bus, Freightliner Custom Chassis and others have led to the introduction of a number of new propane-powered vehicles and engines. Industry partnerships with additional original equipment manufacturers, including the PERC partnership with Freightliner, have the potential to expand the number of vehicles and engines available to the market in the longer term.

The introduction of new propane-powered vehicles is expected to generate a near-term increase in propane sales in this market. Propane school bus sales are expected to account for about 10% of the total school bus market in 2015, and propane vehicles are making significant gains in other fleet vehicle markets such as box trucks and shuttle vans. However, the propane industry will need to overcome significant market hurdles to maximize sales in this sector. “In the past, much of the alternative fuel market has been driven by customer preferences to be seen as ‘green,’ as well as the need to comply with alternative fuel requirements and objectives rather than for cost or performance reasons,” ICF underscores. “In addition, much of the alternative fuel market has been sustained by fuel and refueling infrastructure tax incentives.”

Conversely, more recently the growth in propane vehicle sales has been driven by the difference between propane and gasoline/diesel prices in vehicle fleet applications. Fuel cost savings enable propane vehicles to make sense on a straight economic basis in most small to mid-size fleet applications, including school buses, shuttles and taxis, delivery vehicle fleets, law enforcement fleets, and other fleet vehicle applications where vehicles are based at a single location. The recent decline in oil prices has reduced the fuel cost savings associated with propane, but has not eliminated the total cost of ownership economic benefits associated with converting to propane vehicles.

ICF estimates that about 12,900 new propane vehicles were sold or converted in 2014. It projects total propane vehicle sales and conversions to increase to 52,000 a year by 2025. That growth in new propane vehicle sales is expected to be split 40% for light duty and 60% for medium duty. Most of the medium-duty vehicles are expected to be OEM vehicles, while most of the light-duty vehicles are expected to be conversions.