Tuesday, June 7, 2016

The propane industry made a strong showing at the ACT (Advanced Clean Transportation) Expo May 2016 in Long Beach, Calif., with a focus on propane at a session on urban mobility and various booths showing the latest products. The event featured the appearance of a PSI propane-fueled (LP) terminal tractor prototype and an agreement for ICOM North America to supply liquid injection propane systems for vehicles and school buses for

First Priority Green Fleet.

“We love being at ACT because it’s the merger of futuristic technologies and emissions and clean air and gives us a chance to talk about how propane meets that today,” said Tucker Perkins, chief business development officer for the Propane Education & Research Council (PERC).

PERC had a booth at the show and was a Gold Sponsor of the event. Roush CleanTech, CleanFUEL USA, ICOM North America, and the United Propane AutoGas Solutions (UPAS) Group were among the propane industry companies with booths promoting their latest products and services.

Perkins spoke at a session on “The Future of Urban Mobility: Advanced Technologies That Will Transform Our Cities,” telling attendees that 9000 school buses hauled half a million children to school on propane school buses that morning. The propane school bus market did not even exist 10 years ago, he said. Today, every school bus manufacturer offers a propane product.

He went on to discuss the fleet market, noting that fleet buyers decide on propane almost exclusively for the emissions benefits. The fleet drivers also prefer propane vehicles, the communities like that propane is a domestic clean-burning fuel, and fleet maintenance staff say propane vehicles are easier to maintain than diesel. School administrators talk about how the fuel cost savings from propane allows them to use the extra funding to hire more teachers or to buy equipment for activities such as the school band or football team.

Perkins told attendees how Virginia Commonwealth University is using propane-fueled shuttle buses, how successful propane has been in the taxicab market in areas such as Las Vegas and Detroit, and how police fleets are also moving quickly to propane.

He promoted propane’s successful use in Ford trucks. “We’ve been talking about the most storied truck in the U.S., the F-150,” Perkins noted. “We have liquid California-certified, vapor EPA-only, multiple models of aftermarket bi-fuel, so whatever you want, we have a Ford truck. I think that typifies where our market has gone, from nothing to a very aggressive market in models and applications.” He provided a list of “Why Fleets Choose Propane Autogas,” with reasons such as total cost of ownership, reduced maintenance, driver morale/employee retention, and noise reduction.

“I don’t think we talk about [noise] enough,” he stressed. “Our drivers consistently say ‘I prefer driving a propane vehicle because it’s quieter.’ When you used to have diesel buses, my kids never missed the bus, because I knew three blocks away where the bus was.” He went on to tell attendees about his “favorite application,” a propane-powered pothole patcher, and added that is one of various “unique applications that work in cities today and will work in cities in the future.”

He called direct injection “the future of propane” and added that “the marriage of propane into a direct-injection engine brings us technology we have never seen before,” with reduced emissions, better power, and better fuel efficiency, all at a lower cost.

He talked about bio-propane, noting that although propane supply is currently high, the industry is looking at bio-propane for the future. Plants are producing bio-propane in Europe, and “we know that is the path for us in the U.S. in the future.”

Speaking with BPN from the show floor on May 4 following his presentation, Perkins mentioned Tico Manufacturing’s announcement at the expo that it would showcase a prototype of a new propane-fueled terminal tractor powered by the PSI 8.8-liter engine. PERC has been engaged in the port tractor market for about three years. He said the new Tico product would allow the propane industry to push various products at different ports as a strong option for materials handling. Many port tractors use about 10,000 gallons of propane a year, so they are a great propane autogas gallon-growing opportunity.

Several other propane industry vendors and partners spoke with BPN from the show floor, including Ralph Perpetuini, CEO of ICOM North America (New Hudson, Mich.).

Icom is optimistic about the propane industry, and Perpetuini discussed the First Priority Green Fleet agreement, noting that First Priority is a manufacturer and distributor for Lion School Bus and other companies that produce propane, hybrid, electric, and compressed natural gas vehicles.

“It’s exciting,” Perpetuini stated. “We’ll get our propane fuel injection systems on vehicles and through customers that First Priority already has on their customer list.”

He also disclosed that Icom had just received EPA certifications for approximately 100 GM vehicle platforms for 2016-model 6.0L and 4.8L Chevrolet Silverado pickups, cutways, and vans. The company is awaiting certification for its system on Ford’s direct-injection EcoBoost engine for the Ford Explorer, F-150, and Taurus, and he added that Icom also expects a certification soon for the 2016 Ford 6.2-liter F-250 and F-350.

“It definitely broadens our already very wide and extended range of over 700 EPA-certified platforms,” and it allows Icom to offer fleets a propane system for all of its vehicles, not just a few.

CleanFUEL USA (Georgetown, Texas) displayed its newest fueling product, the Elaflex Euro nozzle that includes eConnect software technology for remote access to diagnostics and reporting. CleanFUEL USA founder and president Curtis Donaldson was at ACT Expo and explained that the Euro nozzle name is somewhat misleading because it’s predominantly used in Spain and Portugal, not throughout Europe. “Elaflex has over 90% of that market share. They have produced more Euro-nozzles than any other manufacturer. It is the preferred choice.”

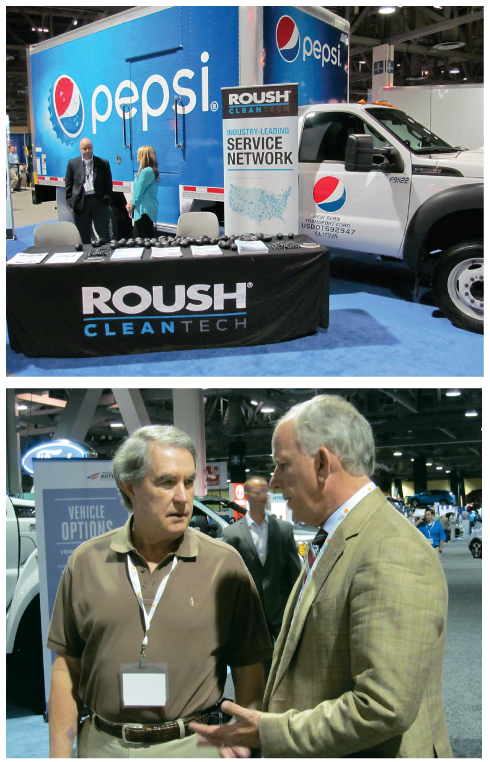

Various additional propane products garnered attention at the event, including applications that Perkins of PERC pointed out were not in existence only seven or eight years ago. He noted that a beverage delivery truck, on display at the show, was the result of a partnership between Roush CleanTech (Livonia, Mich.) and Mickey Truck Bodies (High Point, N.C.). Mickey Truck Bodies has been around a while, but the body with a propane system is new. Roush also displayed an F-550 Pepsi truck.

Todd Mouw, vice president of sales and marketing at Roush CleanTech, confirmed the company was having its best year ever, and that its focus on the Class 4-7 vehicles and the school bus business has paid off. More than 500 school districts are using Bluebird school buses with the Roush CleanTech propane fueling system. His company works with Bluebird dealers and the school districts to capture lifecycle cost, fuel cost, and maintenance data that helps Roush CleanTech make the case for propane autogas.

“We have a TCO [total cost of ownership] calculator with Bluebird, and we help the school districts calculate their savings,” Mouw said. “It’s powerful stuff.”

He added that four to five beverage distributors in California will test the Mickey Body beverage delivery truck and that one California water delivery company will soon replace some older trucks and is testing the Mickey Body/Roush truck.

“They have already got the infrastructure,” Mouw stated. “Being able to stay with propane and move to the more modern technology with liquid injection is the desired path.” He added that the paratransit industry is probably Roush CleanTech’s second-fastest growing market behind school buses. The E-450 and F-550 burn a lot of fuel and come back to a central spot each evening. He revealed that a “major transit agency in Delaware” will soon announce it is converting much of its fleet to propane.

Many companies are switching their fleets of vehicles over to propane autogas, but the propane industry itself has been slow to adopt the fuel for its own fleets.

Michael Taylor, director of autogas business development for PERC, discussed a recent PERC report titled “Growing Gallons Within the Industry,” which explores why propane marketers are resisting using propane autogas for their own fleets, even though they could achieve greater total cost of ownership savings by doing so. The report uses information from a past paper by Mike Sloan of ICF International and notes that the total propane bobtail population is about 21,712, with each vehicle expected to travel about 30,000 miles per year. If each bobtail consumed about 5000 gallons of propane annually, that would translate to an addition of more than 108 million gallons of demand just by converting bobtails to propane.

“Being a former employee of a marketer and playing the role of fleet director, honestly I don’t understand why more propane marketers aren’t buying propane-powered vehicles,” said Taylor, who is a former fleet director for Heritage Propane. The report acknowledges that diesel is cleaner today but it still comes with a cost. When Taylor worked for Heritage, it was known that the company’s productivity went down because of the requirements to operate and maintain diesel engines.

He noted that bobtails are similar to school buses, which have seen wide adoption of propane autogas. “We’re very similar markets, but in terms of gross vehicle weight rating, it’s a similar payload, and we have a lot of stop-and-go routes just like school buses do, so to me it’s a no-brainer for a propane marketer to make this decision.”

The PERC report discusses barriers to marketer adoption of propane autogas such as durability of the engines, but Taylor responded that propane engines today are very durable. “They’re going to supply you with the duty cycles that are required over the lifetime of the bobtail or any Class 7 vehicle.” Taylor added, “Durability is no longer a question.” The report lists “lack of preferred vehicles” as another barrier, but Taylor countered that Freightliner Custom Chassis and Ford offer Class 7 products. In addition, PERC is working with Navistar and has talked with Kenworth and Peterbilt about offering propane products.

“These are perceived barriers to adoption,” Taylor noted. “You are going to pay more upfront for the price of the propane [vehicle]. But when you look at the cost of the fuel, the reduced maintenance cost, you don’t have what I call the 3 Fs — the fuel costs, additional fluids and filters required on diesels — there’s huge savings.”

Ted Olsen of propane fleet fuel provider network Arro AutoGas also attended ACT Expo, promoting propane through the PERC booth and chatting with potential customers for the Arro Autogas network. He pointed out that the network is up to 22 propane autogas stations and that it opened four or five this past winter.

“We’re looking for fleet customers who might be interested in getting propane vehicles in the California area,” Olsen remarked. “I’ll introduce them to my stations so they know where they can get fuel 24/7 through the Arro AutoGas network.” —Daryl Lubinsky

First Priority Green Fleet.

“We love being at ACT because it’s the merger of futuristic technologies and emissions and clean air and gives us a chance to talk about how propane meets that today,” said Tucker Perkins, chief business development officer for the Propane Education & Research Council (PERC).

PERC had a booth at the show and was a Gold Sponsor of the event. Roush CleanTech, CleanFUEL USA, ICOM North America, and the United Propane AutoGas Solutions (UPAS) Group were among the propane industry companies with booths promoting their latest products and services.

Perkins spoke at a session on “The Future of Urban Mobility: Advanced Technologies That Will Transform Our Cities,” telling attendees that 9000 school buses hauled half a million children to school on propane school buses that morning. The propane school bus market did not even exist 10 years ago, he said. Today, every school bus manufacturer offers a propane product.

He went on to discuss the fleet market, noting that fleet buyers decide on propane almost exclusively for the emissions benefits. The fleet drivers also prefer propane vehicles, the communities like that propane is a domestic clean-burning fuel, and fleet maintenance staff say propane vehicles are easier to maintain than diesel. School administrators talk about how the fuel cost savings from propane allows them to use the extra funding to hire more teachers or to buy equipment for activities such as the school band or football team.

Perkins told attendees how Virginia Commonwealth University is using propane-fueled shuttle buses, how successful propane has been in the taxicab market in areas such as Las Vegas and Detroit, and how police fleets are also moving quickly to propane.

He promoted propane’s successful use in Ford trucks. “We’ve been talking about the most storied truck in the U.S., the F-150,” Perkins noted. “We have liquid California-certified, vapor EPA-only, multiple models of aftermarket bi-fuel, so whatever you want, we have a Ford truck. I think that typifies where our market has gone, from nothing to a very aggressive market in models and applications.” He provided a list of “Why Fleets Choose Propane Autogas,” with reasons such as total cost of ownership, reduced maintenance, driver morale/employee retention, and noise reduction.

“I don’t think we talk about [noise] enough,” he stressed. “Our drivers consistently say ‘I prefer driving a propane vehicle because it’s quieter.’ When you used to have diesel buses, my kids never missed the bus, because I knew three blocks away where the bus was.” He went on to tell attendees about his “favorite application,” a propane-powered pothole patcher, and added that is one of various “unique applications that work in cities today and will work in cities in the future.”

He called direct injection “the future of propane” and added that “the marriage of propane into a direct-injection engine brings us technology we have never seen before,” with reduced emissions, better power, and better fuel efficiency, all at a lower cost.

He talked about bio-propane, noting that although propane supply is currently high, the industry is looking at bio-propane for the future. Plants are producing bio-propane in Europe, and “we know that is the path for us in the U.S. in the future.”

Speaking with BPN from the show floor on May 4 following his presentation, Perkins mentioned Tico Manufacturing’s announcement at the expo that it would showcase a prototype of a new propane-fueled terminal tractor powered by the PSI 8.8-liter engine. PERC has been engaged in the port tractor market for about three years. He said the new Tico product would allow the propane industry to push various products at different ports as a strong option for materials handling. Many port tractors use about 10,000 gallons of propane a year, so they are a great propane autogas gallon-growing opportunity.

Several other propane industry vendors and partners spoke with BPN from the show floor, including Ralph Perpetuini, CEO of ICOM North America (New Hudson, Mich.).

Icom is optimistic about the propane industry, and Perpetuini discussed the First Priority Green Fleet agreement, noting that First Priority is a manufacturer and distributor for Lion School Bus and other companies that produce propane, hybrid, electric, and compressed natural gas vehicles.

“It’s exciting,” Perpetuini stated. “We’ll get our propane fuel injection systems on vehicles and through customers that First Priority already has on their customer list.”

He also disclosed that Icom had just received EPA certifications for approximately 100 GM vehicle platforms for 2016-model 6.0L and 4.8L Chevrolet Silverado pickups, cutways, and vans. The company is awaiting certification for its system on Ford’s direct-injection EcoBoost engine for the Ford Explorer, F-150, and Taurus, and he added that Icom also expects a certification soon for the 2016 Ford 6.2-liter F-250 and F-350.

“It definitely broadens our already very wide and extended range of over 700 EPA-certified platforms,” and it allows Icom to offer fleets a propane system for all of its vehicles, not just a few.

CleanFUEL USA (Georgetown, Texas) displayed its newest fueling product, the Elaflex Euro nozzle that includes eConnect software technology for remote access to diagnostics and reporting. CleanFUEL USA founder and president Curtis Donaldson was at ACT Expo and explained that the Euro nozzle name is somewhat misleading because it’s predominantly used in Spain and Portugal, not throughout Europe. “Elaflex has over 90% of that market share. They have produced more Euro-nozzles than any other manufacturer. It is the preferred choice.”

Various additional propane products garnered attention at the event, including applications that Perkins of PERC pointed out were not in existence only seven or eight years ago. He noted that a beverage delivery truck, on display at the show, was the result of a partnership between Roush CleanTech (Livonia, Mich.) and Mickey Truck Bodies (High Point, N.C.). Mickey Truck Bodies has been around a while, but the body with a propane system is new. Roush also displayed an F-550 Pepsi truck.

Todd Mouw, vice president of sales and marketing at Roush CleanTech, confirmed the company was having its best year ever, and that its focus on the Class 4-7 vehicles and the school bus business has paid off. More than 500 school districts are using Bluebird school buses with the Roush CleanTech propane fueling system. His company works with Bluebird dealers and the school districts to capture lifecycle cost, fuel cost, and maintenance data that helps Roush CleanTech make the case for propane autogas.

“We have a TCO [total cost of ownership] calculator with Bluebird, and we help the school districts calculate their savings,” Mouw said. “It’s powerful stuff.”

He added that four to five beverage distributors in California will test the Mickey Body beverage delivery truck and that one California water delivery company will soon replace some older trucks and is testing the Mickey Body/Roush truck.

“They have already got the infrastructure,” Mouw stated. “Being able to stay with propane and move to the more modern technology with liquid injection is the desired path.” He added that the paratransit industry is probably Roush CleanTech’s second-fastest growing market behind school buses. The E-450 and F-550 burn a lot of fuel and come back to a central spot each evening. He revealed that a “major transit agency in Delaware” will soon announce it is converting much of its fleet to propane.

Many companies are switching their fleets of vehicles over to propane autogas, but the propane industry itself has been slow to adopt the fuel for its own fleets.

Michael Taylor, director of autogas business development for PERC, discussed a recent PERC report titled “Growing Gallons Within the Industry,” which explores why propane marketers are resisting using propane autogas for their own fleets, even though they could achieve greater total cost of ownership savings by doing so. The report uses information from a past paper by Mike Sloan of ICF International and notes that the total propane bobtail population is about 21,712, with each vehicle expected to travel about 30,000 miles per year. If each bobtail consumed about 5000 gallons of propane annually, that would translate to an addition of more than 108 million gallons of demand just by converting bobtails to propane.

“Being a former employee of a marketer and playing the role of fleet director, honestly I don’t understand why more propane marketers aren’t buying propane-powered vehicles,” said Taylor, who is a former fleet director for Heritage Propane. The report acknowledges that diesel is cleaner today but it still comes with a cost. When Taylor worked for Heritage, it was known that the company’s productivity went down because of the requirements to operate and maintain diesel engines.

He noted that bobtails are similar to school buses, which have seen wide adoption of propane autogas. “We’re very similar markets, but in terms of gross vehicle weight rating, it’s a similar payload, and we have a lot of stop-and-go routes just like school buses do, so to me it’s a no-brainer for a propane marketer to make this decision.”

The PERC report discusses barriers to marketer adoption of propane autogas such as durability of the engines, but Taylor responded that propane engines today are very durable. “They’re going to supply you with the duty cycles that are required over the lifetime of the bobtail or any Class 7 vehicle.” Taylor added, “Durability is no longer a question.” The report lists “lack of preferred vehicles” as another barrier, but Taylor countered that Freightliner Custom Chassis and Ford offer Class 7 products. In addition, PERC is working with Navistar and has talked with Kenworth and Peterbilt about offering propane products.

“These are perceived barriers to adoption,” Taylor noted. “You are going to pay more upfront for the price of the propane [vehicle]. But when you look at the cost of the fuel, the reduced maintenance cost, you don’t have what I call the 3 Fs — the fuel costs, additional fluids and filters required on diesels — there’s huge savings.”

Ted Olsen of propane fleet fuel provider network Arro AutoGas also attended ACT Expo, promoting propane through the PERC booth and chatting with potential customers for the Arro Autogas network. He pointed out that the network is up to 22 propane autogas stations and that it opened four or five this past winter.

“We’re looking for fleet customers who might be interested in getting propane vehicles in the California area,” Olsen remarked. “I’ll introduce them to my stations so they know where they can get fuel 24/7 through the Arro AutoGas network.” —Daryl Lubinsky