Tuesday, February 13, 2018

For many parts of the U.S., the second half of December 2017 was one of the coldest on record. This was followed by 2018 being welcomed by more frigid weather that held on, with only a few small breaks that allowed marketers just a bit of time to catch up.

Although it appeared the fourth quarter of 2017 would replicate the previous two warmer-than-normal winters, as the year wrapped up cold temperatures that blanketed much of the nation prompted the industry to shift into overdrive in a way unseen since the polar vortex of 2014.

In describing the situation, John Powell, senior vice president and CCO for Crestwood’s Marketing Supply & Logistics Group, said, “It is very challenging for everyone right now as demand is exceeding the last polar vortex we had four years ago. Since the fourth quarter was warmer than normal, there was no urgency to press deliveries during the holiday season, however, sustained weather came the last week of December and it’s continued to be much colder than normal in January.” He noted that as of mid-January the industry was about two weeks in arrears, and that if the cold weather continued, that could put everyone three weeks behind.

The combination of the new electronic logging devices and some cold weather during the holidays at the end of 2017 put some retailers and carriers behind, according to Bryon Muchow, Crestwood’s vice president of mid-continent marketing and supply. “The cold temperatures have continued, putting further strain on transportation as well as supply, causing long lines at the terminals,” he said. “In this environment, the retail market is more efficient than the supply/transportation market.” Several retail propane marketers told BPN the new electronic logs were being blamed for loads not arriving on time. In many states, prior to the waiver of hours-of-service restrictions just before Christmas, several retailers had stories of trucks less than 30 minutes away from delivery destinations having to pull over to comply with the new electronic devices. On occasion, this prevented bobtails from being able to load first thing in the morning.

“The waiver of hours-of-service restrictions was one of several government actions that happened quickly due to thorough communication with regulatory authorities,” said Jeff Petrash, National Propane Gas Association (NPGA) vice president and general counsel. “If there were any benefits from the polar vortex of 2013-14, one would be the preparations in place for this winter.” He explained that many relationships were created with various government agencies during the crisis of early 2014 and communication with these entities continued. “We track data a lot better than we did before 2013-14. We communicate with Midwest governors, New England governors, the Department of Transportation (DOT), the Federal Energy Regulatory Commission (FERC), and several other energy associations.”

NPGA learned that some retail propane marketers in Southern Ohio and Kentucky were short-filling tanks to make sure that everyone had gas. Muchow also heard about short-filling in various parts of the country. Both the TEPPCO and Dixie pipelines have been on allocation. “We’re glad to hear about companies being proactive to ensure everyone has gas, even though it costs the retailer more. It’s better than the black eye the companies and industry get when companies run out of gas,” Petrash said. He added that customers do not like the price spikes that often come with supply and distribution challenges, but pointed out that electric and natural gas are also prone to price spikes. “Often the electric and natural gas companies blend in higher energy costs with other lower-cost purchases.”

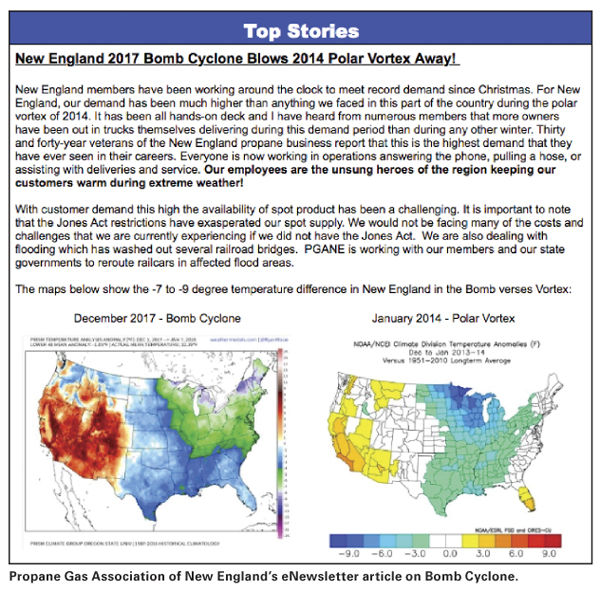

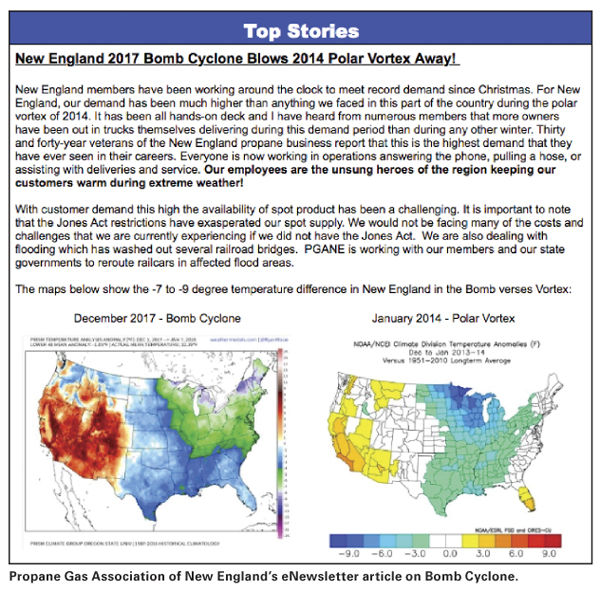

“New England 2017 Bomb Cyclone Blows 2014 Polar Vortex Away!” That headline went out with a mid-January electronic newsletter from the Propane Gas Association of New England (PGANE). In the newsletter, PGANE president and CEO Leslie Anderson said members faced more demand than during the polar vortex of 2014. Anderson, who also chairs the Propane Education & Research Council’s (PERC) Supply Task Force, noted that many 30- and 40-year industry veterans were saying this is the most demand they have seen in their careers and that facing the demand has been an all-hands-on-deck situation. More owners than ever before have been out delivering gas themselves; everyone was working in operations, either answering the phone, pulling a hose, or assisting with deliveries and service. “Our employees are the unsung heroes of the region, keeping our customers warm during extreme weather.”

Anderson noted that with customer demand this high the availability of spot product has been a challenge. She explained the Jones Act restrictions have exacerbated New England spot supply. “We would not be facing many of the costs and challenges that we are currently experiencing if we did not have the Jones Act.” In addition to the innumerable demand challenges, flooding washed out several railroad bridges and forced industry members and state governments to reroute railcars in affected areas.

“Demand is off the charts,” said New York Propane Gas Association executive director and technical director Shane Sweet. “We have logistical issues, but we don’t have a shortage in New York. We have enough propane in Point A, but more is needed in Point B.” He expressed concern about five-hour waits at terminals and drivers who get frustrated with waiting and then drive farther to get a load of gas. “Drivers are spending a lot of time in line in addition to still driving three or more extra hours round trip to get a load of gas.” Sweet added, “People were starting to believe it was never going to warm up again.” While he appreciated the quick waiver of hours of service limits, he noted that Canada did not waive hours-of-service, which negatively impacts a lot of New York distribution.

Both Powell and Crestwood vice president of east marketing and supply, Chris Roth, are pleased with the performance of Crestwood’s new Montgomery terminal in New York. “The Montgomery terminal is working great and doing exactly what we expected it to do,” Roth said. The new state-of-the-art terminal, believed to be the largest propane terminal in the U.S., can load four trucks in 15 minutes and has been very busy during its first winter. “With our Montgomery terminal, the industry is going to realize that having a supply point a lot closer to the demand locations is of value, and as truck transportation continues to rationalize, the amount of supply closer to demand will be imperative,” Powell said.

According to Roth, when it gets cold, the first constraint on transportation is long lines at various terminals. “When that happens, drivers start to lose hours of service sitting in line, or they have to go to another terminal that’s farther away, taking even more time. Drivers who may normally do three loads from one original destination combination in a day may only be able to do one.” But now marketers can get trucks out of line and over to Montgomery and load fast. “The sheer capacity at Montgomery helps relieve a lot of pressure in that region. So instead of going farther away or sitting in a long line at another terminal, they can go to Montgomery and be loaded and on their way in 30 minutes gate-to-gate.”

From hurricanes to fires to cold temps to mudslides, almost no part of the U.S. escaped Mother Nature’s wrath. A winter season that started with hurricanes severely affecting marketers in Texas, Florida, and Puerto Rico, among others, seemed to be an otherwise mild one for most of the fourth quarter. Wildfires affected Northern and Southern California as well as Montana during the fall. “We deal with the aftermath of the fires working alongside the Office of Emergency Services (OES), the Environmental Protection Agency (EPA), and the Federal Emergency Management Agency (FEMA),” said Joy Alafia, Western Propane Gas Association president and CEO. “Retailers were in the field, inspecting tanks and transporting damaged tanks to a staging area. Clean-up from the fires in the northern part of California concluded in early January, but clean-up in Southern California is still ongoing.” Alafia is not aware of any damaged tanks from the Santa Barbara area, but notes recovery efforts are just getting underway following the January mudslides, which were the result of the largest wildfire that burned throughout the region just prior to the torrential rains.

Industry leaders who have been so challenged by Mother Nature this season are hopeful that there will be no recurrence of the natural disasters Santa Barbara experienced recently. NPGA, the World LPG Association, and PERC meet there in mid-February. “Yes, I think we’ll all be ready for a break from nature’s challenges when we get to Santa Barbara,” said Deb Grooms, CEO of the Iowa Propane Gas Association. Grooms, who also serves on the PERC Supply Task Force, has been focused on winter supply issues almost since 2016 ended. “Everyone was really ready for the hours of service to be waived when it happened. The allocation was causing trucks to travel farther to get propane. It has really helped to have the Midwest Governors Association calls to stay ahead of potential problems and bring quick solutions,” she said, noting that calls usually have representation from state propane gas association executives, the Governor’s staff, DOT, Department of Agriculture, and wholesale suppliers.

Evaluating what was done right and what needs to be done better in the future, an email to industry members from NPGA president and CEO Rick Roldan outlined several areas where the association has been particularly active. These include:

• “Salted the Roads Before It Snows”—met with FMCSA officials prior to the winter heating season to urge prospective hours-of-service waivers. This set the stage for FMCSA’s original regional waivers of hours-of-service rules affecting 37 states.

• Requested an extension of the FMCSA regional waivers and received it within 24 hours. Extended waivers [were] in place through Jan. 28, 2018.

• Urged aggressive action with the Surface Transportation Board to ensure peak winter demands are met. Engaged CSX and CN officials in the same manner.

• Briefed the Federal Energy Regulatory Commission in October on the status of propane days of supply and the pipeline infrastructure.

• Convinced the Energy Information Administration to incorporate exports into its data publications to better reflect current marketplace dynamics.

• Hosted or participated in multiple teleconferences with regional energy groups and policymakers to share information.

Sweet and North Carolina Propane Gas Association president and CEO John Jessup are both concerned by the media’s use of the word “shortage” when cold weather hits. “We no sooner have logistical challenges than the New York attorney general hears someone say the word ‘shortage’ and starts to investigate price gouging. We’ve had nothing near a price gouging situation,” commented Sweet. In describing his experience, Jessup said that when the hours-of-service rules were waived, within 45 minutes of the governor signing it a TV news station wanted to interview him on the propane shortage. “I explained that we were experiencing a logistical issue and not a shortage.”

Both Muchow and Roth have recognized that transportation has been a challenge this winter. “Virtually every terminal has had to go on ratable allocation,” Roth said. “What that means is, if you have a contract at a supply location for, say 300,000 gallons in the month of January, you can’t lift all 300,000 gallons in the first week. You can only take 10,000 gallons a day for 30 days. And that’s not enough for the retailers to catch up, let alone maintain their existing demands.” He explained that this causes a snowball effect as demand exceeds the limits of their primary supply origins and they are forced to go farther and farther away to find supply. “That in turn means the industry is getting shorter and shorter on transportation.”

“Going forward, retailers need to continue to reevaluate their supply plans to ensure they are diversified — that they’re not relying on one terminal — and that they have a solid contingency plan for extra gallons,” Muchow observed. “Further, they need to fully understand their carrier’s seasonal capabilities and how that does, or doesn’t, fit into their supply plan. Supply and transportation planning should go hand in hand.”

Roth reminds retailers that every weather event, whether it’s a really warm winter or a really cold winter, provides an opportunity for marketers to reevaluate their businesses and not overreact. “Retailers should always evaluate their needs based on historical averages, accounting for customer growth, and not just base their needs on the most recent events. After three warm winters in a row, it may have been tempting to put all your eggs in one basket or commit to fewer term gallons. However, without thoughtful supply planning, based on price and reliability and proper contingency planning, cold weather events can turn from a challenging situation to an absolutely critical situation for your business.” — Pat Thornton

Although it appeared the fourth quarter of 2017 would replicate the previous two warmer-than-normal winters, as the year wrapped up cold temperatures that blanketed much of the nation prompted the industry to shift into overdrive in a way unseen since the polar vortex of 2014.

In describing the situation, John Powell, senior vice president and CCO for Crestwood’s Marketing Supply & Logistics Group, said, “It is very challenging for everyone right now as demand is exceeding the last polar vortex we had four years ago. Since the fourth quarter was warmer than normal, there was no urgency to press deliveries during the holiday season, however, sustained weather came the last week of December and it’s continued to be much colder than normal in January.” He noted that as of mid-January the industry was about two weeks in arrears, and that if the cold weather continued, that could put everyone three weeks behind.

The combination of the new electronic logging devices and some cold weather during the holidays at the end of 2017 put some retailers and carriers behind, according to Bryon Muchow, Crestwood’s vice president of mid-continent marketing and supply. “The cold temperatures have continued, putting further strain on transportation as well as supply, causing long lines at the terminals,” he said. “In this environment, the retail market is more efficient than the supply/transportation market.” Several retail propane marketers told BPN the new electronic logs were being blamed for loads not arriving on time. In many states, prior to the waiver of hours-of-service restrictions just before Christmas, several retailers had stories of trucks less than 30 minutes away from delivery destinations having to pull over to comply with the new electronic devices. On occasion, this prevented bobtails from being able to load first thing in the morning.

“The waiver of hours-of-service restrictions was one of several government actions that happened quickly due to thorough communication with regulatory authorities,” said Jeff Petrash, National Propane Gas Association (NPGA) vice president and general counsel. “If there were any benefits from the polar vortex of 2013-14, one would be the preparations in place for this winter.” He explained that many relationships were created with various government agencies during the crisis of early 2014 and communication with these entities continued. “We track data a lot better than we did before 2013-14. We communicate with Midwest governors, New England governors, the Department of Transportation (DOT), the Federal Energy Regulatory Commission (FERC), and several other energy associations.”

NPGA learned that some retail propane marketers in Southern Ohio and Kentucky were short-filling tanks to make sure that everyone had gas. Muchow also heard about short-filling in various parts of the country. Both the TEPPCO and Dixie pipelines have been on allocation. “We’re glad to hear about companies being proactive to ensure everyone has gas, even though it costs the retailer more. It’s better than the black eye the companies and industry get when companies run out of gas,” Petrash said. He added that customers do not like the price spikes that often come with supply and distribution challenges, but pointed out that electric and natural gas are also prone to price spikes. “Often the electric and natural gas companies blend in higher energy costs with other lower-cost purchases.”

“New England 2017 Bomb Cyclone Blows 2014 Polar Vortex Away!” That headline went out with a mid-January electronic newsletter from the Propane Gas Association of New England (PGANE). In the newsletter, PGANE president and CEO Leslie Anderson said members faced more demand than during the polar vortex of 2014. Anderson, who also chairs the Propane Education & Research Council’s (PERC) Supply Task Force, noted that many 30- and 40-year industry veterans were saying this is the most demand they have seen in their careers and that facing the demand has been an all-hands-on-deck situation. More owners than ever before have been out delivering gas themselves; everyone was working in operations, either answering the phone, pulling a hose, or assisting with deliveries and service. “Our employees are the unsung heroes of the region, keeping our customers warm during extreme weather.”

Anderson noted that with customer demand this high the availability of spot product has been a challenge. She explained the Jones Act restrictions have exacerbated New England spot supply. “We would not be facing many of the costs and challenges that we are currently experiencing if we did not have the Jones Act.” In addition to the innumerable demand challenges, flooding washed out several railroad bridges and forced industry members and state governments to reroute railcars in affected areas.

“Demand is off the charts,” said New York Propane Gas Association executive director and technical director Shane Sweet. “We have logistical issues, but we don’t have a shortage in New York. We have enough propane in Point A, but more is needed in Point B.” He expressed concern about five-hour waits at terminals and drivers who get frustrated with waiting and then drive farther to get a load of gas. “Drivers are spending a lot of time in line in addition to still driving three or more extra hours round trip to get a load of gas.” Sweet added, “People were starting to believe it was never going to warm up again.” While he appreciated the quick waiver of hours of service limits, he noted that Canada did not waive hours-of-service, which negatively impacts a lot of New York distribution.

Both Powell and Crestwood vice president of east marketing and supply, Chris Roth, are pleased with the performance of Crestwood’s new Montgomery terminal in New York. “The Montgomery terminal is working great and doing exactly what we expected it to do,” Roth said. The new state-of-the-art terminal, believed to be the largest propane terminal in the U.S., can load four trucks in 15 minutes and has been very busy during its first winter. “With our Montgomery terminal, the industry is going to realize that having a supply point a lot closer to the demand locations is of value, and as truck transportation continues to rationalize, the amount of supply closer to demand will be imperative,” Powell said.

According to Roth, when it gets cold, the first constraint on transportation is long lines at various terminals. “When that happens, drivers start to lose hours of service sitting in line, or they have to go to another terminal that’s farther away, taking even more time. Drivers who may normally do three loads from one original destination combination in a day may only be able to do one.” But now marketers can get trucks out of line and over to Montgomery and load fast. “The sheer capacity at Montgomery helps relieve a lot of pressure in that region. So instead of going farther away or sitting in a long line at another terminal, they can go to Montgomery and be loaded and on their way in 30 minutes gate-to-gate.”

From hurricanes to fires to cold temps to mudslides, almost no part of the U.S. escaped Mother Nature’s wrath. A winter season that started with hurricanes severely affecting marketers in Texas, Florida, and Puerto Rico, among others, seemed to be an otherwise mild one for most of the fourth quarter. Wildfires affected Northern and Southern California as well as Montana during the fall. “We deal with the aftermath of the fires working alongside the Office of Emergency Services (OES), the Environmental Protection Agency (EPA), and the Federal Emergency Management Agency (FEMA),” said Joy Alafia, Western Propane Gas Association president and CEO. “Retailers were in the field, inspecting tanks and transporting damaged tanks to a staging area. Clean-up from the fires in the northern part of California concluded in early January, but clean-up in Southern California is still ongoing.” Alafia is not aware of any damaged tanks from the Santa Barbara area, but notes recovery efforts are just getting underway following the January mudslides, which were the result of the largest wildfire that burned throughout the region just prior to the torrential rains.

Industry leaders who have been so challenged by Mother Nature this season are hopeful that there will be no recurrence of the natural disasters Santa Barbara experienced recently. NPGA, the World LPG Association, and PERC meet there in mid-February. “Yes, I think we’ll all be ready for a break from nature’s challenges when we get to Santa Barbara,” said Deb Grooms, CEO of the Iowa Propane Gas Association. Grooms, who also serves on the PERC Supply Task Force, has been focused on winter supply issues almost since 2016 ended. “Everyone was really ready for the hours of service to be waived when it happened. The allocation was causing trucks to travel farther to get propane. It has really helped to have the Midwest Governors Association calls to stay ahead of potential problems and bring quick solutions,” she said, noting that calls usually have representation from state propane gas association executives, the Governor’s staff, DOT, Department of Agriculture, and wholesale suppliers.

Evaluating what was done right and what needs to be done better in the future, an email to industry members from NPGA president and CEO Rick Roldan outlined several areas where the association has been particularly active. These include:

• “Salted the Roads Before It Snows”—met with FMCSA officials prior to the winter heating season to urge prospective hours-of-service waivers. This set the stage for FMCSA’s original regional waivers of hours-of-service rules affecting 37 states.

• Requested an extension of the FMCSA regional waivers and received it within 24 hours. Extended waivers [were] in place through Jan. 28, 2018.

• Urged aggressive action with the Surface Transportation Board to ensure peak winter demands are met. Engaged CSX and CN officials in the same manner.

• Briefed the Federal Energy Regulatory Commission in October on the status of propane days of supply and the pipeline infrastructure.

• Convinced the Energy Information Administration to incorporate exports into its data publications to better reflect current marketplace dynamics.

• Hosted or participated in multiple teleconferences with regional energy groups and policymakers to share information.

Sweet and North Carolina Propane Gas Association president and CEO John Jessup are both concerned by the media’s use of the word “shortage” when cold weather hits. “We no sooner have logistical challenges than the New York attorney general hears someone say the word ‘shortage’ and starts to investigate price gouging. We’ve had nothing near a price gouging situation,” commented Sweet. In describing his experience, Jessup said that when the hours-of-service rules were waived, within 45 minutes of the governor signing it a TV news station wanted to interview him on the propane shortage. “I explained that we were experiencing a logistical issue and not a shortage.”

Both Muchow and Roth have recognized that transportation has been a challenge this winter. “Virtually every terminal has had to go on ratable allocation,” Roth said. “What that means is, if you have a contract at a supply location for, say 300,000 gallons in the month of January, you can’t lift all 300,000 gallons in the first week. You can only take 10,000 gallons a day for 30 days. And that’s not enough for the retailers to catch up, let alone maintain their existing demands.” He explained that this causes a snowball effect as demand exceeds the limits of their primary supply origins and they are forced to go farther and farther away to find supply. “That in turn means the industry is getting shorter and shorter on transportation.”

“Going forward, retailers need to continue to reevaluate their supply plans to ensure they are diversified — that they’re not relying on one terminal — and that they have a solid contingency plan for extra gallons,” Muchow observed. “Further, they need to fully understand their carrier’s seasonal capabilities and how that does, or doesn’t, fit into their supply plan. Supply and transportation planning should go hand in hand.”

Roth reminds retailers that every weather event, whether it’s a really warm winter or a really cold winter, provides an opportunity for marketers to reevaluate their businesses and not overreact. “Retailers should always evaluate their needs based on historical averages, accounting for customer growth, and not just base their needs on the most recent events. After three warm winters in a row, it may have been tempting to put all your eggs in one basket or commit to fewer term gallons. However, without thoughtful supply planning, based on price and reliability and proper contingency planning, cold weather events can turn from a challenging situation to an absolutely critical situation for your business.” — Pat Thornton