Friday, October 6, 2017

By John Powell…

For retail and commercial propane distributors, the one certainty about the winter of 2017-2018 is uncertainty in the energy market—with risks to supplies, logistics, propane prices, and your profitability.

Winter weather could return to “normal,” meaning 12% to 15% colder than the past two years, or revisit the deep freeze of a polar vortex, or run a repeat of El Niño-style warmth.

Other concerns also are causing anxiety. Propane pricing is increasingly being driven by global supply and demand as the United States ramps up exports. Lingering impacts from Hurricane Harvey could continue to affect the entire production-to-consumption chain. The psychology of our economy and stock market — currently positive — also could change. As a result, propane pricing and availability seem more uncertain for this winter, particularly in areas at higher risk due to a lack of adequate storage and transportation.

Amid uncertainty, one thing each propane business can do is develop and refine a supply plan to carry it through the winter. Thinking globally and acting locally, you can optimize your supply and pricing, and therefore profitability, for what could be a riskier winter season. Let’s get started.

Analyzing Your Customer Base

The beginning point for a good supply plan is to examine your customer base in detail. We advise our clients to look beyond the past year or two as a baseline. Short-term views leave you vulnerable to unexpected changes. You really need an analytical approach using data for four, five, or more years, spanning different weather and economic situations.

Factors to examine:

Making Sound Weather Assumptions

Each winter’s potential for cold, stormy weather is unpredictable, but with some study you can quantify what a “normal” winter would bring and build a range of sound assumptions around that.

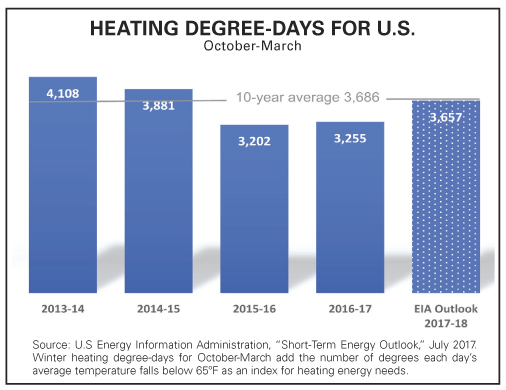

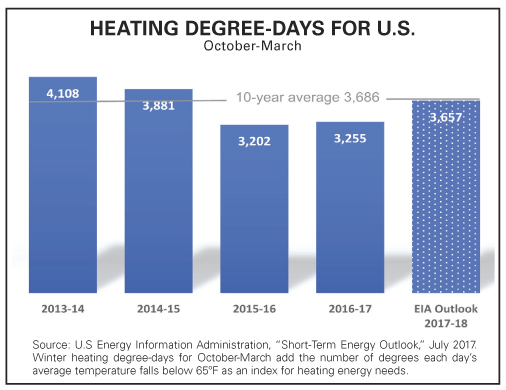

The most likely scenario for 2017-2018 is colder than last winter, according to the U.S. Energy Information Administration. Average temperatures would mean 12%-15% greater heating degree-days (HDDs) than in 2015-2016 or 2016-2017, but 6%-10% lower than the frigid winters of 2013-2014 and 2014-2015. Local or regional data, from private or public sources, offers a more targeted view.

Correlating propane volumes with quantitative measures of weather will suggest a range of possible outcomes. You might use an average winter’s weather as a baseline, with a range bracketed at the top by your coldest winter in recent years and at the low end by your warmest winter in recent history.

Remember that the thermometer alone does not determine demand. Changes in customers’ habits to be more efficient after the price spike four years ago might mean homes and businesses will use less propane this year, even if the winter is cold. There’s no substitute for getting to know customers.

Watching Out for the 800-Pound Gorilla

Apart from weather, the big picture in supply and demand has morphed into something new. While supply has increased with rising U.S. production since 2011, global demand is the really dramatic change. Propane exports have grown to nearly half of U.S. production, so international factors have become the 800-pound gorilla in pricing and supply allocation.

In years gone by, a propane dealer might have thought only about supplies in relation to residential, commercial, agricultural, and industrial customers within range of a bobtail. Now that U.S. marketers compete for gallons in a market where overseas buyers are the big spenders, conflicts in places like Venezuela or the Middle East can cause big disruptions in what used to be a domestic market.

The consulting firm ICF International, in a detailed analysis of the 2017 outlook, commented: “The propane supply balance has shifted from an over-supplied domestic market with prices below sustainable levels…to an export-driven market [in which] retailers will need to compete for tight supplies and volatile prices with unexpected weather and international market factors.” By staying informed on global news, propane dealers can keep an eye on that 800-pound gorilla.

Examining Risks to Your Supply

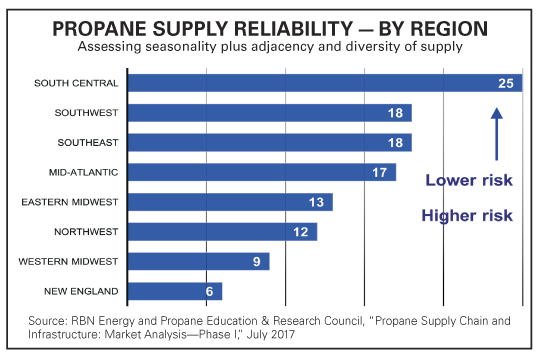

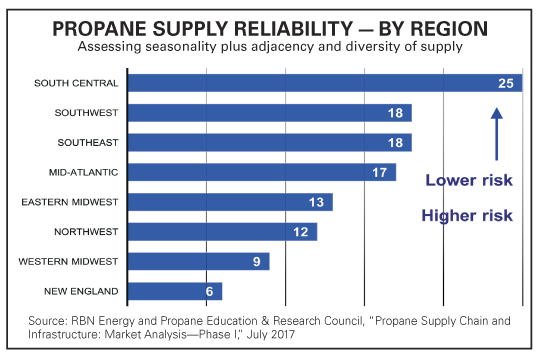

After two relatively tranquil winters, propane businesspeople can’t afford to be complacent about the supply-demand balance. A plan must address structural risks built into your supply chain. Besides global uncertainties and fickle weather, supply is highly dependent on regional risk factors such as variations in sources of supply and transportation infrastructure. This summer, the Propane Education & Research Council (PERC) and RBN Energy quantified these regional differences to assess the reliability of supplies. The study reported that New England and western Midwest states pose the most risks, while three regions across the southern U.S. are the least challenging.

The Northeast illustrates multiple vulnerabilities. Recent rail service issues in the region, while not impacting consumers during the off season, could cause major disruptions if the problems continue. The Northeast could also see exports grow by 100,000 bbld to 200,000 bbld after the Mariner East 2 (ME2) pipeline comes online. For marketers in the Northeast, supply from Ohio and Pennsylvania has been underappreciated during mild winters — but gallons could get scarce if a spike in global demand happens to coincide with a colder winter at home.

Wherever you are, this is a good time—if you haven’t already done so — to sit down with your supplier. Get an in-depth understanding of where your fuel comes from, how it travels to you, and what the risks are. Crestwood is always having consultative discussions to help each customer profile — and mitigate — their supply risks. You need transparency in your supply chain and confidence that you will be able to draw sufficient product, especially in the event of a colder winter, transportation problems, or an international crisis.

Balancing Your Supply and Demand

More than ever, it’s critical to build a supply plan that is flexible enough to adapt to changes, and sufficiently resilient to assure a reliable flow of propane. Getting this right makes the difference between meeting customer needs and earning a good profit, or enduring a winter of headaches.

Working with your supplier to develop a complete supply optimization plan builds trust on both sides and cultivates understanding of your particular supply situation. Together, you can address strengths and weaknesses across your entire business, not just serving a single branch. Some approaches to explore:

John Powell is senior vice president–chief commercial officer of Crestwood Services’ Marketing Supply and Logistics Group. Contact him at This email address is being protected from spambots. You need JavaScript enabled to view it..

For retail and commercial propane distributors, the one certainty about the winter of 2017-2018 is uncertainty in the energy market—with risks to supplies, logistics, propane prices, and your profitability.

Winter weather could return to “normal,” meaning 12% to 15% colder than the past two years, or revisit the deep freeze of a polar vortex, or run a repeat of El Niño-style warmth.

Other concerns also are causing anxiety. Propane pricing is increasingly being driven by global supply and demand as the United States ramps up exports. Lingering impacts from Hurricane Harvey could continue to affect the entire production-to-consumption chain. The psychology of our economy and stock market — currently positive — also could change. As a result, propane pricing and availability seem more uncertain for this winter, particularly in areas at higher risk due to a lack of adequate storage and transportation.

Amid uncertainty, one thing each propane business can do is develop and refine a supply plan to carry it through the winter. Thinking globally and acting locally, you can optimize your supply and pricing, and therefore profitability, for what could be a riskier winter season. Let’s get started.

Analyzing Your Customer Base

The beginning point for a good supply plan is to examine your customer base in detail. We advise our clients to look beyond the past year or two as a baseline. Short-term views leave you vulnerable to unexpected changes. You really need an analytical approach using data for four, five, or more years, spanning different weather and economic situations.

Factors to examine:

- Propane gallons. Your accounting should break out how much fuel you sold, by months or weeks, through the winter season — comparing several years.

- Buying behavior. Mining your database can yield insights into customers’ purchase behaviors — loyalty, reactions to price changes, early-fill or fixed-price participation, etc.

- Energy efficiency. An under-appreciated trend is the move to energy conservation — lowering thermostats and other efficiencies in reaction to past price shocks.

- Local economy. Trends in new housing for your area, particularly homes outfitted for propane heating and other applications, will indicate whether the local market is growing.

Making Sound Weather Assumptions

Each winter’s potential for cold, stormy weather is unpredictable, but with some study you can quantify what a “normal” winter would bring and build a range of sound assumptions around that.

The most likely scenario for 2017-2018 is colder than last winter, according to the U.S. Energy Information Administration. Average temperatures would mean 12%-15% greater heating degree-days (HDDs) than in 2015-2016 or 2016-2017, but 6%-10% lower than the frigid winters of 2013-2014 and 2014-2015. Local or regional data, from private or public sources, offers a more targeted view.

Correlating propane volumes with quantitative measures of weather will suggest a range of possible outcomes. You might use an average winter’s weather as a baseline, with a range bracketed at the top by your coldest winter in recent years and at the low end by your warmest winter in recent history.

Remember that the thermometer alone does not determine demand. Changes in customers’ habits to be more efficient after the price spike four years ago might mean homes and businesses will use less propane this year, even if the winter is cold. There’s no substitute for getting to know customers.

Watching Out for the 800-Pound Gorilla

Apart from weather, the big picture in supply and demand has morphed into something new. While supply has increased with rising U.S. production since 2011, global demand is the really dramatic change. Propane exports have grown to nearly half of U.S. production, so international factors have become the 800-pound gorilla in pricing and supply allocation.

In years gone by, a propane dealer might have thought only about supplies in relation to residential, commercial, agricultural, and industrial customers within range of a bobtail. Now that U.S. marketers compete for gallons in a market where overseas buyers are the big spenders, conflicts in places like Venezuela or the Middle East can cause big disruptions in what used to be a domestic market.

The consulting firm ICF International, in a detailed analysis of the 2017 outlook, commented: “The propane supply balance has shifted from an over-supplied domestic market with prices below sustainable levels…to an export-driven market [in which] retailers will need to compete for tight supplies and volatile prices with unexpected weather and international market factors.” By staying informed on global news, propane dealers can keep an eye on that 800-pound gorilla.

Examining Risks to Your Supply

After two relatively tranquil winters, propane businesspeople can’t afford to be complacent about the supply-demand balance. A plan must address structural risks built into your supply chain. Besides global uncertainties and fickle weather, supply is highly dependent on regional risk factors such as variations in sources of supply and transportation infrastructure. This summer, the Propane Education & Research Council (PERC) and RBN Energy quantified these regional differences to assess the reliability of supplies. The study reported that New England and western Midwest states pose the most risks, while three regions across the southern U.S. are the least challenging.

The Northeast illustrates multiple vulnerabilities. Recent rail service issues in the region, while not impacting consumers during the off season, could cause major disruptions if the problems continue. The Northeast could also see exports grow by 100,000 bbld to 200,000 bbld after the Mariner East 2 (ME2) pipeline comes online. For marketers in the Northeast, supply from Ohio and Pennsylvania has been underappreciated during mild winters — but gallons could get scarce if a spike in global demand happens to coincide with a colder winter at home.

Wherever you are, this is a good time—if you haven’t already done so — to sit down with your supplier. Get an in-depth understanding of where your fuel comes from, how it travels to you, and what the risks are. Crestwood is always having consultative discussions to help each customer profile — and mitigate — their supply risks. You need transparency in your supply chain and confidence that you will be able to draw sufficient product, especially in the event of a colder winter, transportation problems, or an international crisis.

Balancing Your Supply and Demand

More than ever, it’s critical to build a supply plan that is flexible enough to adapt to changes, and sufficiently resilient to assure a reliable flow of propane. Getting this right makes the difference between meeting customer needs and earning a good profit, or enduring a winter of headaches.

Working with your supplier to develop a complete supply optimization plan builds trust on both sides and cultivates understanding of your particular supply situation. Together, you can address strengths and weaknesses across your entire business, not just serving a single branch. Some approaches to explore:

- Place orders ahead of time. If you put off planning, hoping to catch a break on spot purchases, you are vulnerable to price spikes and temporary shortages at various supply points.

- Use appropriate contracts to lock in fuel for your commitments under fixed-price agreements with customers, matching supply with demand. As more customers sign on, you can add more contracts to match those commitments and assure your margin.

- Study transportation and supply points. Dealers previously called multiple suppliers to find gallons, but consolidation means larger suppliers now are diversified enough to meet all foreseeable challenges.

- Simplify your transactions. If your dealings with each supplier are time-efficient, your relationship is more economical. For example, organize the right information before calling in an order.

- Get supply and pricing information from market services, and take advantage of real-time data offered by your supplier to help guide your decisions.

John Powell is senior vice president–chief commercial officer of Crestwood Services’ Marketing Supply and Logistics Group. Contact him at This email address is being protected from spambots. You need JavaScript enabled to view it..