Monday, July 22, 2019

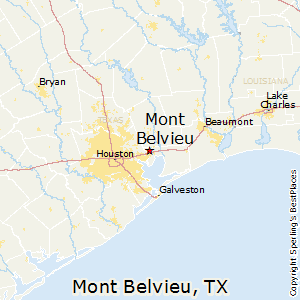

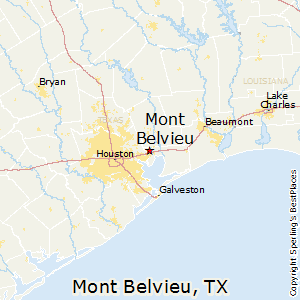

(July 22, 2019) — The U.S. and global LPG markets will remain partitioned until new export capacity enables more North American product to reach Asia and other markets, according to ESAI Energy’s newly published Global NGL 12-Month Outlook, and as reported by Hydrocarbon Engineering. And the relinking of North America and the world market has bullish implications for Mont Belvieu NGL prices and U.S. export volumes.

ESAI Energy writes that the impact of the temporary partitioning of markets is evident in both prices and inventories. Due to a scarcity of U.S. product in overseas markets, inventories in Japan, South Korea, and Taiwan are at unusually low levels, nearly 7 MMbbl lower compared to a year ago.

Simultaneously, U.S. propane stocks are soaring, and as a consequence Mont Belvieu propane has been trading at a $15 discount to Japanese spot prices. As ESAI describes it, the partition will last until Enterprise Products commissions new terminal capacity in the third quarter of this year.

“The current situation resembles the period prior to 2016 when U.S. NGL prices were suppressed due to a lack of LPG export infrastructure,” said ESAI Energy head of NGLs Andrew Reed. “The markets will relink quickly, however, once Enterprise’s new terminal begins operating. Then, LPG exporters’ fortunes will hinge on the fragility of global demand growth.”

(SOURCE: The Weekly Propane Newsletter, July 22, 2019)

ESAI Energy writes that the impact of the temporary partitioning of markets is evident in both prices and inventories. Due to a scarcity of U.S. product in overseas markets, inventories in Japan, South Korea, and Taiwan are at unusually low levels, nearly 7 MMbbl lower compared to a year ago.

Simultaneously, U.S. propane stocks are soaring, and as a consequence Mont Belvieu propane has been trading at a $15 discount to Japanese spot prices. As ESAI describes it, the partition will last until Enterprise Products commissions new terminal capacity in the third quarter of this year.

“The current situation resembles the period prior to 2016 when U.S. NGL prices were suppressed due to a lack of LPG export infrastructure,” said ESAI Energy head of NGLs Andrew Reed. “The markets will relink quickly, however, once Enterprise’s new terminal begins operating. Then, LPG exporters’ fortunes will hinge on the fragility of global demand growth.”

(SOURCE: The Weekly Propane Newsletter, July 22, 2019)